Why Scraping Moneycontrol Is a Smart Move for Real-Time Market Insights

In 2023, India saw over 12 crore (120 million) active demat accounts—a 15% jump from the previous year. More people are investing, trading, and building tools around the stock market than ever before. With this surge, the demand for real-time stock market data has exploded.

But here’s the problem: reliable, real-time data isn’t easy to come by — especially if you’re working with Indian markets. The big financial APIs (like Bloomberg or Refinitiv) are expensive. Free APIs are limited, delayed, or don’t cover the Indian market well. And if you’re a quant, data engineer, or fintech dev trying to build anything useful — from a trading model to a price alert app — that’s a dealbreaker.

That’s why so many professionals turn to Moneycontrol. It’s one of the most trusted platforms in India for market data. Prices update frequently, there’s detailed info on every stock, and the site also pulls in useful extras — like financials, earnings news, analyst commentary, and live indices. But while it’s great for browsing, there’s no official API that lets you pull this data into your systems.

So the workaround? You scrape it — carefully, legally, and efficiently.

This guide breaks down exactly how to do that. You’ll learn:

- What kind of data can you get from Moneycontrol

- How scraping compares to APIs

- The legal and technical things to keep in mind

- And how to scale it all with help from a professional data partner, if needed

If you’re serious about building tools that depend on real-time stock market data, scraping Moneycontrol is one of the most practical ways to get what you need.

What Kind of Stock Market Data Can You Get from Moneycontrol?

If you’ve spent any time on Moneycontrol, you already know it’s packed with data. But before you start scraping, it’s worth being clear on exactly what you can extract, because this will help you plan your crawler and avoid wasting resources.

Here’s a breakdown of the main types of stock market data available on Moneycontrol:

1. Real-Time Stock Quotes

You can get live price updates for individual stocks, including:

- Current price

- Day high and low

- Volume traded

- Price change and percentage change

- Bid/ask spread

These values refresh every few seconds on the site, which is why many traders scrape this data to feed their dashboards or alerts.

2. Index Data

Whether it’s NIFTY 50, Sensex, or sector-specific indices, Moneycontrol provides regular updates on index performance, constituent movement, and daily charts. This is useful for building market trend indicators or sector rotation models.

3. Company-Specific Information

Each company page contains a rich set of structured and semi-structured data:

- Financial results (quarterly and annual)

- Balance sheet and income statement data

- Peer comparison

- Corporate announcements and news

- Management commentary and presentations

If you’re building a fundamental analysis model, this is gold.

4. Market News and Sentiment

The platform also curates financial news and analyst views from multiple sources. Scraping this can help in tracking market sentiment around specific sectors, companies, or even events like earnings releases.

5. Historical Data

While not always presented in easy-to-export tables, you can still extract past performance data, chart prices, and previous financials if you structure your crawler to dig deep into each stock’s page.

Moneycontrol offers most of what a financial analyst or developer needs. You just need to know where to look and how to extract it cleanly.

Where to Get Stock Market Data and Why Scraping Moneycontrol Makes Sense

When you’re building trading tools, financial models, or real-time dashboards, your first instinct is usually to look for an API. That makes sense — APIs are fast, structured, and built for integration. But here’s the issue: most stock market data APIs are either expensive, limited, or don’t cover Indian stocks in real time.

Let’s look at your typical options:

The Traditional API Route

Big platforms like Bloomberg, Reuters, and Morningstar offer rich datasets, but the pricing is enterprise-level. Unless you’re part of a large institution, it’s usually out of reach. Even the more accessible platforms like Alpha Vantage or Yahoo Finance either:

- Don’t support Indian exchanges properly,

- Only offer delayed data (by 15 minutes or more),

- Or limit how much data you can pull in a day.

If you’re trying to track live prices, monitor a full watchlist, or build real-time alerts, these limits become a serious roadblock.

Why Scraping Is a Practical Alternative

Scraping Moneycontrol offers a way around this. It’s not about bypassing the system — it’s about accessing publicly visible information and turning it into structured, machine-readable data.

Here’s why scraping makes sense:

- No paywall: The data is openly available on Moneycontrol — you’re not breaking into anything.

- Updated frequently: Quotes and indices refresh often enough to be useful for intraday models and dashboards.

- Deep coverage: Moneycontrol covers thousands of stocks, sectors, indices, and company pages — much more than most free APIs.

- No hard limits: If you manage your request rate and follow ethical scraping practices, you can pull in more data than most APIs allow.

Of course, scraping isn’t perfect — there are challenges (we’ll cover those later). But if you’re working with Indian markets and need real-time stock market data, scraping Moneycontrol is one of the most cost-effective and flexible solutions out there.

How to Scrape Moneycontrol for Stock Market Data: A Step-by-Step Guide

Scraping Moneycontrol isn’t overly complex, but to do it well (and legally), you need to approach it the right way. Below is a walk-through of how to scrape stock market data from Moneycontrol using Python-based tools. This will help you build something reliable, whether you’re just experimenting or building something to scale.

Step 1: Choose the Right Tools

Most developers use Python because of its powerful scraping libraries and ease of use. Here’s what you’ll typically work with:

- Requests and BeautifulSoup – Great for simple pages where data is in the HTML.

- Selenium – Useful when content is loaded dynamically with JavaScript.

- Scrapy – A full-fledged scraping framework, ideal for more complex, high-volume crawls.

- Pandas – To clean and structure the data once it’s scraped.

- LXML – For faster and more efficient parsing (especially if you’re dealing with large pages).

Start small. If you’re just trying to extract live prices or company financials, you don’t need to overengineer it.

Step 2: Identify the Right URLs and Data Points

Take any NSE-listed company — say, Infosys. Go to its Moneycontrol page. You’ll notice:

- The livestock price is displayed in a specific HTML element.

- Financials, ratios, and charts are tucked into tabbed sections, each with its own URL or dynamic load.

Right-click → Inspect Element (in Chrome) will show you the structure. Find the div, span, or table tag that contains the data you want. That’s what you’ll target in your scraper.

Here’s a simple example using requests and BeautifulSoup:

python

CopyEdit

import requests

from bs4 import BeautifulSoup

url = ‘https://www.moneycontrol.com/india/stockpricequote/computers-software/infosys/IT’

headers = {‘User-Agent’: ‘Mozilla/5.0’}

response = requests.get(url, headers=headers)

soup = BeautifulSoup(response.text, ‘lxml’)

price_tag = soup.find(‘div’, {‘id’: ‘nsecp’}) # This may change – always inspect

print(“Current price:”, price_tag.text)

Remember: Moneycontrol changes its structure often. You need to adjust your selectors if things stop working.

Step 3: Deal with JavaScript-Rendered Content

Some parts of Moneycontrol, like dynamic charts or news tickers, load using JavaScript. In these cases, requests won’t work. You’ll need Selenium to load the page like a browser does.

Here’s a quick Selenium snippet:

python

CopyEdit

from selenium import webdriver

from selenium.webdriver.chrome.options import Options

options = Options()

options.headless = True

driver = webdriver.Chrome(options=options)

driver.get(‘https://www.moneycontrol.com/india/stockpricequote/computers-software/infosys/IT’)

price = driver.find_element(‘id’, ‘nsecp’).text

print(“Live price:”, price)

driver.quit()

This gives you more flexibility, but it’s slower and heavier. Best used when there’s no other way.

Step 4: Clean, Structure, and Store the Data

Once you’ve extracted what you need:

- Use Pandas to structure it into a DataFrame

- Save it as a CSV, send it to a database, or feed it into a model

- Schedule it using cron or APScheduler to run every minute/hour

You can also log failures, handle retries, and add checks for missing data, especially if you’re scraping every few seconds.

Step 5: Respect the Rules, Ethical and Legal Scraping

Just because the data is public doesn’t mean you can hammer the site. Scraping responsibly means:

- Checking robots.txt (Moneycontrol doesn’t openly allow crawling on many pages, so you must tread carefully)

- Not overloading their servers — always throttle your requests

- Avoiding login-protected or paywalled data

- Not redistributing the raw data commercially unless you have permission

Scraping should be about enhancing your internal workflows, not reselling someone else’s content.

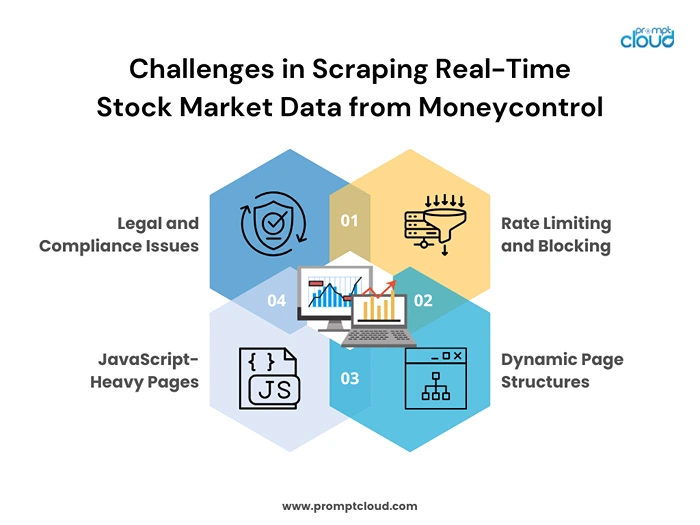

Challenges in Scraping Real-Time Stock Market Data from Moneycontrol

Scraping real-time stock market data isn’t always smooth sailing. Even if you get the initial version working, keeping it reliable at scale is where most people run into trouble. Let’s break down some of the common challenges when scraping Moneycontrol and how you can stay ahead of them.

1. Rate Limiting and Blocking

Moneycontrol doesn’t publicly offer a scraping-friendly API, so if you send too many requests in a short span, you may start getting blocked or throttled. You might see responses failing, pages not loading, or getting redirected.

How to handle it:

- Introduce random delays between requests (1–5 seconds).

- Rotate user agents to avoid detection.

- Use proxies, especially if you’re scraping in parallel or frequently. Residential proxies work better than datacenter ones for this use case.

The goal is to look like a normal user browsing the site, not a bot hitting the same endpoint every second.

2. Dynamic Page Structures

Moneycontrol frequently updates its UI. A small redesign could break all your scrapers, especially if you’re relying on specific HTML tags or element IDs.

How to stay ahead:

- Avoid hard-coding tag hierarchies — use more resilient selectors (like labels or nearby elements).

- Test your crawler daily to catch silent failures early.

- Consider using XPath or more dynamic matching logic instead of brittle div > span > p chains.

If your scraping system feeds live dashboards or trading signals, even a day of broken data can be costly, so build monitoring into your pipeline.

3. JavaScript-Heavy Pages

As mentioned earlier, parts of Moneycontrol are rendered with JavaScript. If you’re only using requests, you’ll miss those elements. This affects:

- Interactive charts

- News tickers

- Some newer financial sections

Workaround:

- Use Selenium or Playwright to render JS content

- Cache page results if you’re scraping the same data for multiple use cases

But be warned: headless browsers consume more memory and CPU. You’ll need to scale carefully if you’re dealing with high volume.

4. Legal and Compliance Issues

This is a serious one. Just because data is visible doesn’t mean it’s free to take, store, or resell.

Moneycontrol’s terms of use typically prohibit large-scale extraction or commercial reuse of their content without permission.

Best practice:

- Use scraped data for internal analysis only — dashboards, trading strategies, or backtests

- Don’t build products on top of scraped data unless you have a commercial license

- Always check robots.txt and respect site policies

Want to play it safe and stay compliant? That’s where professional scraping services come in — we’ll get to that soon.

Real-World Use Cases of Scraped Moneycontrol Data

When you’re pulling structured, real-time stock market data from a rich source like Moneycontrol, the applications go far beyond just watching prices tick. Whether you’re a quant, fintech dev, or data scientist, this data can power smarter, faster, and more customized financial tools.

Let’s explore some of the ways scraped Moneycontrol data is used in practice.

1. Real-Time Dashboards for Traders and Analysts

Traders don’t just need prices — they need context. By scraping:

- Live stock quotes,

- Indices, and

- Top gainers/losers,

You can build real-time dashboards tailored to your watchlist, sector interests, or market exposure.

Instead of relying on slow APIs or generic platforms, you get a custom front-end with exactly the insights you care about. This is especially useful for firms that need internal monitoring tools across multiple asset classes.

2. Backtesting and Strategy Optimization

Moneycontrol offers more than prices. With access to historical charts, financial ratios, and company fundamentals, you can:

- Feed your backtesting engine,

- Simulate trades based on historical signals,

- Compare how your models would have performed in different market conditions.

Most free APIs don’t offer granular past data for Indian stocks — scraping fills that gap for quantitative analysts working on alpha models or machine learning-driven strategies.

3. Portfolio Monitoring and Alerts

If you’re a fintech startup building investment apps or wealth tech products, scraped data lets you:

- Push alerts when a stock crosses a price threshold,

- Trigger notifications on volume spikes or news releases,

- Monitor user portfolios in real time.

Since the Moneycontrol app is used by millions, its pricing and news feeds often reflect the pulse of the Indian retail investor. Tapping into that makes your tools smarter and more responsive.

4. Sentiment and News Signal Extraction

Moneycontrol’s news section aggregates updates from business wire services, analysts, and media sources. You can:

- Scrape headlines, timestamps, and tickers mentioned,

- Feed this into a natural language processing (NLP) pipeline,

- Generate sentiment scores for each stock.

This is useful for hedge funds and algo desks that want to track market-moving news and correlate it with intraday stock moves.

5. Competitor Benchmarking

B2B fintech products and brokerages can scrape:

- Peer financials,

- Valuations,

- Sector trends,

to provide comparative insights within client portals or research platforms. This supports tools like stock comparison widgets or customized portfolio recommendations based on peer performance.

Clearly, the data you scrape from Moneycontrol isn’t just raw numbers — it becomes the fuel for smarter tools and sharper decisions. But there’s still one question: Should you build and maintain this scraper yourself, or is there a better way?

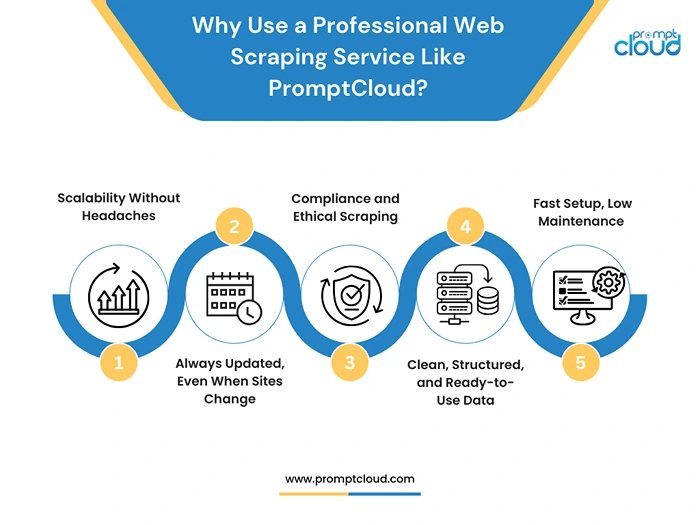

Why Use a Professional Web Scraping Service Like PromptCloud?

Scraping Moneycontrol for stock market data might sound straightforward — until it starts breaking in the middle of trading hours, or you’re asked to scale from 10 stocks to 10,000 across multiple exchanges.

Here’s where a managed solution like PromptCloud comes in.

1. Scalability Without Headaches

Let’s say you start by scraping 100 tickers a day. Then your team wants live data for every NIFTY 500 stock, plus company profiles, news, and indices — refreshed every 5 minutes.

That’s no longer a script — it’s infrastructure.

PromptCloud offers a fully-managed data service, meaning we handle the infrastructure, scheduling, crawling, cleaning, and delivery at any scale. You don’t need to worry about bandwidth, proxies, concurrency, or error handling.

2. Always Updated, Even When Sites Change

As we’ve discussed, Moneycontrol’s layout changes frequently. A class name gets updated, or a JS framework gets replaced, and suddenly, your scraper is collecting nothing, or worse, incorrect data.

With PromptCloud, you get data monitoring and scraper maintenance as part of the service. Our systems automatically detect site structure changes, and our engineering team updates the extractors, so your pipeline stays reliable.

This is critical when your downstream apps or trading decisions depend on uninterrupted real-time data.

3. Compliance and Ethical Scraping

Navigating the legal and ethical side of scraping is tricky, especially with financial data. PromptCloud takes a compliance-first approach:

- We respect robots.txt directives,

- Avoid scraping pages behind login/paywalls,

- And adhere to content usage policies.

You also get access to data delivery formats (JSON, CSV, XML) tailored for your internal systems, helping you stay productive and compliant.

4. Clean, Structured, and Ready-to-Use Data

Most in-house scrapers require post-processing — stripping HTML, cleaning symbols, handling Unicode, or standardizing time zones. With PromptCloud, the data comes pre-cleaned, well-structured, and ready for ingestion into:

- Databases,

- BI tools,

- Data lakes,

- Trading engines.

This cuts down engineering overhead and lets your team focus on analysis, not plumbing.

5. Fast Setup, Low Maintenance

Instead of spending weeks building, debugging, and maintaining scrapers, PromptCloud lets you go live fast. You tell us:

- What data you need (stock quotes, company profiles, news, etc.),

- How often you want it,

- Where to send it (S3, API, FTP, etc.).

We take care of everything else. No DevOps. No code rewrites. No outages.

For data teams in finance, time is money, and your scrapers should work for you, not against you.

Why Scrape Moneycontrol for Real-Time Market Insights?

When it comes to making informed decisions in the stock market, having real-time data is crucial. Moneycontrol has long been a go-to resource for traders and analysts in India, offering a treasure trove of stock quotes, company data, financial news, and more. However, gathering all this valuable information manually or relying on limited APIs can be time-consuming and inefficient.

That’s where scraping Moneycontrol comes in. By automating the process, you can unlock consistent access to the data that matters most for your trading strategies, market analysis, and even sentiment tracking.

Why PromptCloud Makes Scraping Moneycontrol Easier

While scraping Moneycontrol might sound straightforward, doing it at scale without running into issues like site changes or IP blocking can be a headache. That’s where PromptCloud steps in. Our solution ensures you don’t have to worry about maintaining scrapers, dealing with data interruptions, or managing compliance.

With PromptCloud, you get:

- Fast and reliable data delivery, so you can make timely decisions.

- Scalability to handle even the most complex and high-volume data requirements.

- Professional-grade data cleaning to ensure you’re always working with accurate, structured data.

- Compliance with ethical scraping practices, so you can focus on what matters without worrying about legal concerns.

If you’re serious about leveraging real-time stock market data from Moneycontrol, PromptCloud is here to make sure your data pipeline runs smoothly. You can rely on us to extract, clean, and deliver the data you need, without all the hassle.So, if you’re looking to tap into the wealth of stock market insights Moneycontrol has to offer, get in touch with PromptCloud today. Let’s take your market intelligence to the next level without all the stress of DIY scraping.