What is Alternative Data

In the high-stakes game of hedge fund investing, fortune favors the bold and the well-informed. As the saying goes, “knowledge is power” and the ability to connect the dots between seemingly unrelated pieces of information can be the difference between success and failure. In today’s increasingly data-driven investment landscape, alternative data for hedge funds has emerged as a vital resource to gain an edge over their competitors. Our previous article introduced various alternative data sources and in this article and In this follow-up article, we will explore the importance of alternative data and how it enables hedge funds to connect the dots more effectively, unlocking hidden insights and unique investment opportunities.

We will discuss how hedge funds can harness the power of unconventional data sources to enhance their investment strategies, risk management, and portfolio construction, ultimately leading to superior performance in the complex and ever-changing financial markets.

Why Is It important?

Alternative data is crucial for hedge funds for several reasons, as it offers unique insights and competitive advantages that traditional data sources may not provide. Hedge funds usually leverage the alternate data sources to gain competitive edge and improved investment performance.

Generating Alpha

Generating alpha, or achieving investment returns above the market benchmark, is a primary goal for hedge funds. Alternative data can play a crucial role in this process by providing unique insights and actionable information that may not be readily available through traditional financial data sources. Here’s how hedge funds can generate alpha using alternative data:

- Identifying investment opportunities: Alternative data can reveal potential investment opportunities that may be overlooked by traditional analysis. For example, social media sentiment can help identify consumer trends or product popularity, while geolocation data can provide insights into foot traffic at retail stores, indicating strong or weak performance.

- Enhancing Fundamental Analysis: Incorporating alternative data into traditional fundamental analysis offers a comprehensive view of a company’s performance. For example – A fund can gain additional insights that might not be readily apparent from financial statements alone. For instance, the fund can analyze web traffic data to gauge the popularity of the company’s e-commerce platform or use geolocation data to track foot traffic at its brick-and-mortar stores. Additionally, the hedge fund can monitor social media sentiment to understand customer satisfaction levels and identify potential issues or trends that could impact the company’s future performance.

- Performance validation It refers to the process of confirming or refuting an investment thesis based on insights derived from unconventional data sources. This validation helps hedge funds refine their strategies and ensure they are well-positioned to capitalize on market opportunities.

Improved Risk Management

Alternative data can provide additional insights into potential risks associated with investments, helping hedge funds make better-informed decisions and manage their risk exposure more effectively. Here are some ways alternative data contributes to enhanced risk management:

- Identifying hidden risks Alternative data can uncover potential risks that may not be evident from traditional financial data, such as shifts in consumer sentiment, supply chain disruptions, or emerging regulatory issues. This enables hedge funds to proactively manage these risks and adjust their investment strategies accordingly.

- Stress testing and scenario analysis Hedge funds can use alternative data to conduct stress tests and scenario analyses, helping them better understand the potential impact of various risk factors on their investments and develop strategies to mitigate these risks.

- Tail risk management Alternative data can help hedge funds identify and manage tail risks or extreme events that have a low probability of occurrence but could result in significant losses. By incorporating alternative data into their risk management process, hedge funds can better prepare for and mitigate the impact of these events.

- Quantitative risk modeling Incorporating alternative data into quantitative risk models can enhance their accuracy and predictive power, allowing hedge funds to better measure and manage various types of risk, such as market risk, credit risk, and operational risk.

- Monitoring correlations Alternative data can help hedge funds identify and monitor correlations between different assets, industries, or markets, allowing them to better understand the interdependencies and potential contagion effects that can impact their investments.

Diversification

Incorporating alternative data into investment strategies can help hedge funds create more robust and resilient portfolios. By reducing reliance on traditional data sources, hedge funds can access a broader range of information that can lead to better-informed decisions. Here are some ways alternative data contributes to diversification:

- Uncovering new opportunities Alternative data can reveal opportunities that may be overlooked when relying solely on traditional data sources, such as emerging markets, niche industries, or innovative companies. This can enable hedge funds to invest in a wider range of assets and sectors, reducing concentration risk.

- Reducing information asymmetry Access to alternative data sources can level the playing field for hedge funds, as they can access insights that may not be widely available or recognized in the market. This allows them to make more informed decisions and potentially capitalize on market inefficiencies.

- Improving portfolio construction By incorporating alternative data into their portfolio construction process, they can identify and invest in assets with lower correlations to their existing holdings. This can help optimize the risk-return profile of their portfolios and reduce the impact of market shocks.

- Adaptive investment strategies Alternative data for hedge funds can provide timely insights into changing market conditions, allowing hedge funds to adapt their investment strategies accordingly. This flexibility can help them navigate market turbulence and capitalize on emerging trends.

Early Indicators

Early indicators derived from alternative data for hedge funds can provide hedge funds with valuable insights into shifts in market sentiment, company performance, or industry dynamics, enabling them to act on this information ahead of other market participants. Some ways alternate data serves as early indicators include – Sentiment Analysis, Product Adoption such as web data traffic, app downloads or user engagement metrics can offer early indications of a company’s product or service adoption. This allows them to identify potential winners or losers before the trends are apparent in traditional financial metrics.

Reducing Biases

Alternative data for hedge funds can also helps overcome the limitations of traditional financial data, which can be subject to biases and inaccuracies. By analyzing a variety of alternative data sources, hedge funds can identify and mitigate biases, such as anchoring bias, where investors place too much weight on the first piece of information they receive, or availability bias, where investors overestimate the importance of information that is easily accessible.

We, as humans, are ultimately victims of our own biases. Our decisions and perceptions are influenced by our past experiences, beliefs, and preconceptions, which can limit our ability to make objective and rational decisions. This is especially true in the context of investment decision-making, where cognitive biases can lead to suboptimal investment outcomes.

Why Alternate Data is the Future of Investment Analytics

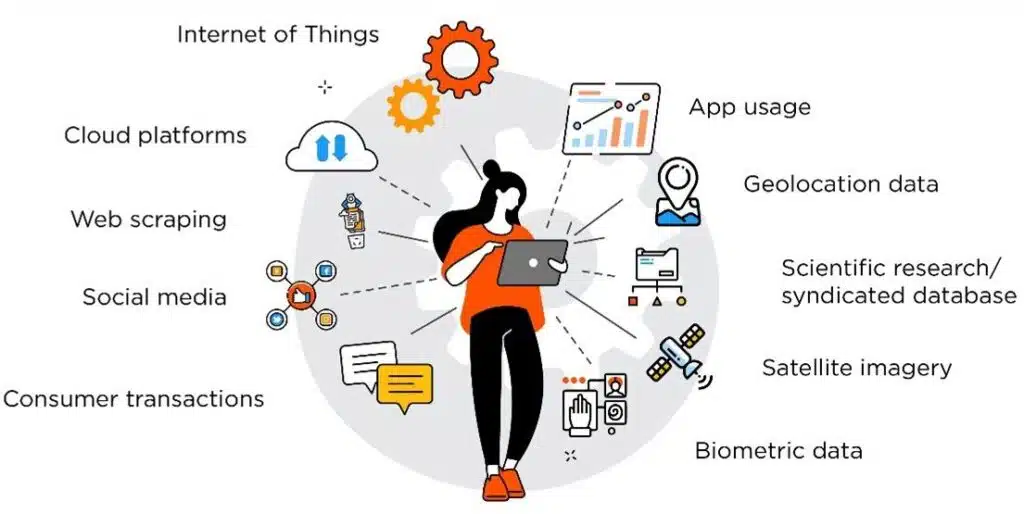

Source: https://www.straive.com/

By incorporating alternative data, hedge funds can reduce the impact of these limitations on their investment decisions and develop more objective and balanced strategies.

Finally, “a stitch in time saves nine” holds true for hedge funds that incorporate data for hedge funds into their investment decision-making process. By staying ahead of the curve with alternative data, hedge funds can ensure they are well-positioned to capitalize on opportunities and mitigate risks, ultimately driving superior investment performance.

Frequently Asked Questions

What is an example of alternative data?

An example of alternative data is social media sentiment analysis. This involves collecting and analyzing social media posts, comments, and interactions to gauge public opinion and sentiment about a specific topic, product, or company. Other examples include satellite imagery for agricultural analysis, transactional data from credit card purchases, and web traffic data.

What is the meaning of alternate data?

Alternative data refers to non-traditional data sources that provide unique insights and information not typically captured by conventional data sets. This data comes from unconventional sources such as social media, web scraping, satellite imagery, transactional data, and other digital footprints. It is often used to enhance decision-making in various fields like finance, marketing, and research.

What is the difference between alternative data and traditional data?

The primary difference between alternative data and traditional data lies in their sources and characteristics:

- Traditional Data: Comes from established, conventional sources such as financial statements, government reports, surveys, and structured databases. It is typically well-organized and standardized.

- Alternative Data: Comes from unconventional, non-traditional sources like social media, web scraping, IoT devices, and satellite imagery. It is often unstructured or semi-structured and requires advanced processing techniques to derive meaningful insights.

What is an alternative dataset?

An alternative dataset is a collection of data obtained from non-traditional sources, providing unique insights that are not available from conventional datasets. These datasets can include data from sources like social media platforms, web traffic, mobile app usage, satellite images, and sensor data from IoT devices. Alternative datasets are valuable for gaining additional perspectives and enhancing predictive models in various industries.