The insurance industry operates in a highly competitive and dynamic environment where understanding market trends, customer needs, and competitor strategies is crucial for success. With pricing and policy structures becoming increasingly sophisticated, staying ahead requires access to accurate, real-time insights. This is where insurance data analytics powered by web scraping plays a transformative role.

Web scraping enables insurance companies to extract valuable information from competitor websites, customer reviews, and industry resources. This data helps insurers monitor competitor policies, optimize pricing, and refine their offerings to align with market demands. Let’s explore how web scraping supports insurance companies in leveraging insurance data analytics to stay competitive.

Why Real-Time Insights Are Crucial for the Insurance Industry?

The insurance market is constantly evolving due to factors like changing customer preferences, regulatory updates, and emerging risks. For instance, the rise of telematics-based auto insurance or new policies for cyber risks demands swift adaptation.

To respond effectively, insurance companies need to:

- Track competitor pricing and policy updates in real time.

- Identify customer expectations and gaps in the market.

- Adapt strategies to regulatory changes and emerging risks.

Traditional methods of data collection – such as market surveys or manual research—are time-consuming and insufficient for real-time decision-making. Web scraping bridges this gap by providing actionable data at scale, fueling insurance data analytics for faster and smarter decisions.

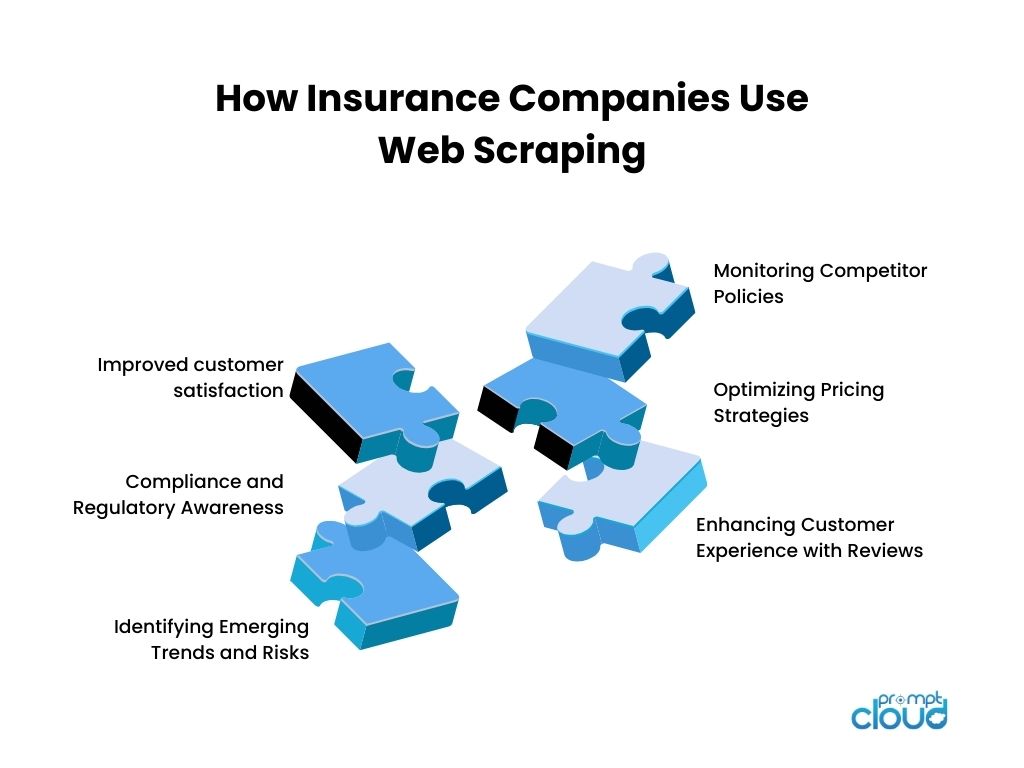

How Insurance Companies Use Web Scraping

Web scraping involves extracting publicly available data from websites, such as competitor insurance offerings, pricing structures, and customer reviews. Here’s how it helps insurance companies optimize their strategies:

1. Monitoring Competitor Policies

Insurance companies need to understand how competitors structure their policies to attract customers. Web scraping helps extract details such as:

- Coverage options and inclusions/exclusions.

- Discounts, loyalty programs, or promotional offers.

- Policy terms, conditions, and premium adjustments.

For instance, an insurer might scrape data from a competitor’s website to identify new add-ons in auto insurance policies, such as roadside assistance or zero-depreciation cover. By analyzing this data, companies can benchmark their offerings and refine their own policies to remain competitive.

2. Optimizing Pricing Strategies

Pricing is one of the most critical factors influencing customer decisions. With web scraping, insurance companies can collect and analyze competitor pricing data to:

- Understand premium structures for different risk categories.

- Monitor regional pricing variations based on location-specific risks.

- Track dynamic pricing changes in response to market trends.

For example, an insurance company could use scraped data to identify a competitor offering lower premiums for low-mileage drivers. Armed with this insight, the insurer might introduce a similar discount, ensuring they remain attractive to cost-conscious customers.

3. Enhancing Customer Experience with Reviews

Customer reviews offer a wealth of information about what policyholders value and what frustrates them. Web scraping reviews from platforms like Trustpilot or Google can provide insights into:

- Common complaints, such as claim delays or lack of transparency.

- Features customers appreciate, like user-friendly apps or fast claim settlements.

- Opportunities to differentiate, such as improved customer support.

By feeding this data into insurance data analytics tools, companies can identify patterns and implement changes that enhance customer satisfaction and loyalty.

4. Identifying Emerging Trends and Risks

Web scraping isn’t limited to competitor websites; it also includes extracting data from industry publications, forums, and social media. This information helps insurers:

- Stay informed about emerging risks, such as climate change or cybersecurity threats.

- Understand shifts in consumer behavior, like the growing demand for pay-as-you-go policies.

- Spot opportunities to create innovative products, such as microinsurance for gig workers.

By analyzing scraped data, insurers can align their strategies with market trends, ensuring their relevance in a rapidly changing landscape.

5. Compliance and Regulatory Awareness

The insurance industry is heavily regulated, with frequent updates to rules and guidelines. Web scraping allows companies to monitor regulatory websites for:

- New compliance requirements in specific regions.

- Changes in solvency or reporting standards.

- Guidelines for pricing fairness and customer protection.

This proactive approach ensures that insurers stay compliant while minimizing risks associated with non-adherence.

How Insurance Data Analytics Drives Strategic Decisions?

While web scraping collects raw data, insurance data analytics transforms this data into actionable insights. Advanced analytics tools process the scraped data to:

- Identify patterns and correlations in competitor pricing.

- Segment customers based on risk profiles and preferences.

- Predict market behavior using historical and real-time data.

For example, integrating scraped data with predictive analytics can help insurers anticipate claim volumes during natural disasters, enabling better preparedness and resource allocation.

Web Scraping Challenges & Ethical Considerations

Although web scraping offers immense benefits, it must be approached responsibly. Challenges include:

- Anti-Scraping Measures: Many websites use CAPTCHAs or IP blocks to prevent automated scraping.

- Data Quality: Extracted data must be cleaned and standardized for effective analysis.

- Regulatory Compliance: Scraping must adhere to privacy laws, such as GDPR, to ensure ethical data use.

Partnering with experienced web scraping providers like PromptCloud helps insurers overcome these challenges while maintaining compliance and data quality.

Why Insurance Companies Must Embrace Web Scraping?

The competitive nature of the insurance industry leaves no room for guesswork. With web scraping and insurance data analytics, companies can:

- Make data-driven decisions with confidence.

- Stay ahead of competitors by tracking policy and pricing trends.

- Deliver personalized experiences that resonate with customers.

- Anticipate risks and adapt to market changes proactively.

How PromptCloud Supports Insurance Companies?

At PromptCloud, we specialize in delivering tailored web scraping solutions to support insurance data analytics. Our services include:

- Customizable Data Feeds: Extract policy details, pricing data, and customer reviews from competitor websites.

- Real-Time Updates: Monitor dynamic data sources to ensure your insights remain current.

- Regulatory Compliance: Adhere to data privacy laws and ethical standards.

- Scalable Solutions: Handle large-scale data extraction for enterprises of all sizes.

By partnering with PromptCloud, insurance companies gain access to reliable, high-quality data that drives innovation and enhances decision-making.

Conclusion:

In a data-driven world, web scraping is no longer optional for insurance companies—it’s essential. By leveraging insurance data analytics powered by web scraping, insurers can monitor competitors, optimize pricing, and deliver customer-centric solutions with precision.

As the industry continues to evolve, companies that embrace these tools will not only stay competitive but also set the standard for innovation and excellence.Are you ready to harness the power of web scraping to transform your insurance business? Let PromptCloud help you unlock actionable insights and achieve your goals. Contact Us Today.