Real estate has always been about location. That hasn’t changed. What has changed is how we understand it.

We’re no longer limited to street views, demographic reports, or a broker’s intuition. Now we have access to location-based data that goes several layers deeper—things like satellite imagery, mobility patterns, land use trends, even environmental risk factors. Put all of that together, and you get what’s now known as geospatial analytics.

It’s not hype. It’s a practical edge.

Real estate teams use this kind of data to analyze markets faster, identify undervalued areas before others spot them, and evaluate risk with far more precision. Developers use it to scout land, retail teams use it to assess foot traffic, and investment managers use it to predict how a location will perform five years out.

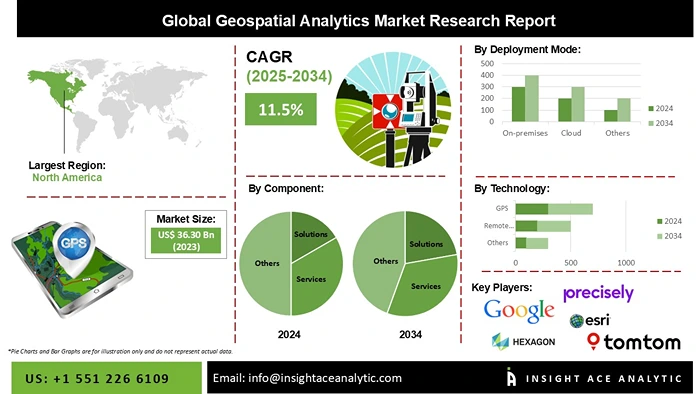

According to MarketsandMarkets, the geospatial analytics market is growing fast—it’s expected to reach over $55.75 billion by 2029. Meanwhile, real estate tech adoption is on the rise, with over 60% of real estate firms now investing in some form of location intelligence.

This shift toward geospatial data analytics isn’t just a tech upgrade. It’s a complete change in how we ask questions and make decisions. You’re not just asking “What’s nearby?”—you’re asking “What’s changing?” and “What’s coming next?”

And the companies that ask those questions first? They’re winning.

What Geospatial Analytics Actually Is (and Why Real Estate Is All Over It)

Image Source: InsightAce

Geospatial analytics isn’t just about maps. It’s about turning location into strategy.

In real estate, that means using data tied to a physical place—satellite imagery, GPS signals, mobility patterns, zoning info, environmental risk layers—and stacking it in a way that tells you more than you could learn on foot or in a spreadsheet.

It’s how you figure out if a quiet neighborhood today is a hot zone five years from now. It’s how you catch regulatory shifts before they hit headlines. It’s how you compare two seemingly identical sites and know which one is actually worth betting on.

Call it what you want—geospatial analytics, geospatial data analytics, or imagery analytics—it all comes down to the same thing: using layered, real-world data to make decisions with fewer assumptions and more proof.

If you’re buying, building, investing, or optimizing a portfolio, and you’re not using this yet, someone else probably is. And they’re seeing something you’re not.

How Satellite Imagery Is Changing the Way We Value Property

Image Source: Google Maps

Most valuation models still lean heavily on comps, local trends, and physical inspections. But those only tell part of the story—usually the past, and usually from a limited vantage point.

Geospatial imagery analytics flips that. With high-resolution satellite and aerial images, you’re no longer guessing what’s around a site or how it’s changed over time. You can see it. Literally.

You can pull up monthly or even weekly images that show development trends, land use changes, encroachments, new infrastructure going in, or even construction slowdowns on neighboring parcels. That kind of visibility makes a big difference, especially when you’re evaluating raw land or edge-of-city assets where the comps are thin and the dynamics are shifting fast.

Say you’re eyeing a piece of land on the outskirts of a growing metro. Traditional tools might say it’s flat, underdeveloped, and risky. But satellite data might show a highway expansion nearby, steady clearing and grading in the area, or that the land is unusually elevated compared to flood-prone zones nearby.

That’s the kind of insight that turns a “maybe” into a clear yes—or a smart pass.

In dense urban markets, imagery helps in a different way: monitoring construction activity, verifying permit compliance, or tracking how quickly new supply is coming online. You can even spot patterns in rooftop solar installations or surface parking conversion—small details that reflect bigger trends.

The point is, valuation is no longer just a snapshot of current conditions. With geospatial imagery analytics, it’s becoming a dynamic, multi-layered process—one that reflects what’s happening now, not just what happened last quarter.

Forecasting What’s Next: How Geospatial Predictive Analytics Spots Growth—and Risk

You can’t afford to be reactive in real estate. By the time a neighborhood looks like a good investment, someone else has already bought the block. That’s why predictive tools are becoming essential, especially ones powered by geospatial analytics.

This isn’t just forecasting based on economic trends. This is looking at how people actually move, where infrastructure is expanding, where natural hazards are intensifying, and where land use is quietly shifting.

That’s where geospatial predictive analytics comes in.

Say you’re an investment firm looking for underpriced markets. With predictive models layered over location data, you can identify areas where traffic patterns are rising, new building permits are clustering, or infrastructure projects (like rail or road expansions) are quietly being approved. You’re not relying on lagging indicators—you’re watching real-time signals.

On the flip side, you can also model risk. Flood zones aren’t static. Neither are wildfire boundaries, heat maps, or soil movement patterns. Combine historical satellite data with environmental layers, and you get a live model of what “risk” actually looks like in a specific location over time. And you can factor that into long-term cap rate projections.

Here’s the point: geospatial analytics in real estate is no longer just about site selection. It’s about forward-looking intelligence. If your models don’t account for location-based trend lines—mobility, zoning shifts, natural risk—you’re flying half blind.

The firms that win in this space aren’t just reacting to comps. They’re anticipating impact. And increasingly, the tools that let them do that are built on geospatial data.

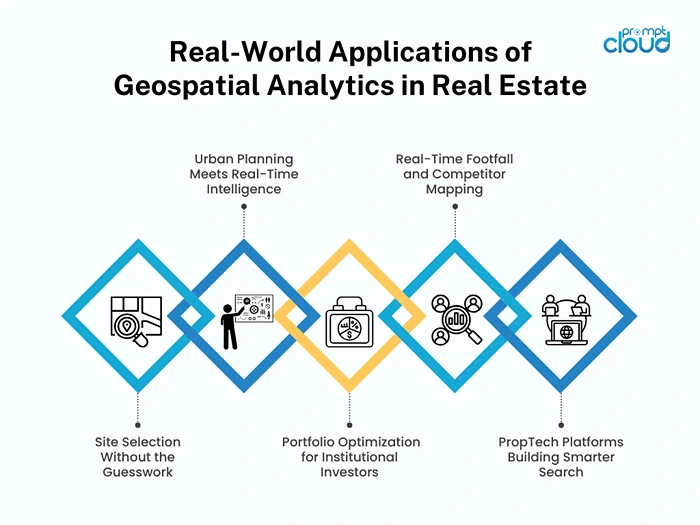

Where It’s Actually Being Used: Real-World Applications of Geospatial Analytics in Real Estate

1. Site Selection Without the Guesswork

A commercial developer is evaluating three plots on the outskirts of Austin. All have similar zoning, price, and acreage. But only one sits just outside a flood risk buffer. And only one is near a soon-to-be-approved rail extension. Satellite imagery and geospatial overlays show exactly which. That’s where they break ground.

No boots on the ground. No wasted due diligence. Just smart use of spatial data.

2. Urban Planning Meets Real-Time Intelligence

A city planning office wants to assess how quickly neighborhoods are densifying. Instead of relying on census data from two years ago, they tap into imagery-based analytics that show changes in rooftop count, building footprints, and vehicle density. The result: zoning changes that actually reflect what’s happening now, not what was true when the last report was filed.

3. Portfolio Optimization for Institutional Investors

A fund managing 40 properties across five states uses geospatial models to assess exposure to climate risk. After layering historical satellite data with FEMA updates and heat trend projections, they flag six assets with elevated long-term risk and prioritize divestment or reinvestment elsewhere. No crystal ball. Just smart, data-led decisions.

4. Retail Footfall and Competitor Mapping

A national QSR chain is scouting locations in a major metro. Instead of just looking at lease prices or street traffic, they use mobile data combined with geospatial analytics to track real-time footfall, time-of-day activity, and proximity to competitors. The site with lower traffic but higher dwell time wins, and they outperform average store sales by 18% in year one.

5. PropTech Platforms Building Smarter Search

One startup is reshaping how buyers search for homes—not just by price or square footage, but by walkability, noise levels, tree cover, and flood risk. All powered by layers of geospatial data. Instead of showing 100 listings, they show five that actually fit the buyer’s lifestyle and risk tolerance.

Every part of the real estate value chain—site selection, planning, acquisition, development, and marketing—is getting sharper because of geospatial analytics. Not because it sounds innovative. But because it works.

If You’re an Investor or Developer, Here’s What Geospatial Analytics Actually Does for You

Let’s not overcomplicate it. You care about risk, returns, and speed. Everything else—tech, tools, buzzwords—is secondary.

So here’s what geospatial analytics does for your real estate strategy:

1. Better Valuations. Less Guesswork.

You’re not relying on stale comps or marketing packages with cherry-picked data. You’re looking at real conditions—flood risk, infrastructure changes, land use shifts—before you even set foot on-site. You don’t get blindsided. You price smarter.

2. Faster, Smarter Decisions.

When you’ve got layers of spatial data at your fingertips, you don’t waste weeks verifying assumptions. You narrow your list in hours. You spend more time negotiating deals and less time validating them. That’s the edge.

3. Early Signals = First-Mover Advantage.

Everyone sees the boom after it happens. You see it coming. Traffic patterns. Permit velocity. Infrastructure investment. Small shifts that signal big moves. You spot the wave before it breaks.

4. Risk That’s Modeled, Not Assumed.

Wildfires, rising sea levels, urban sprawl—none of it’s theoretical anymore. With geospatial data, you’re modeling actual exposure over time, not guessing at it. That makes your underwriting tighter and your exits cleaner.

5. Competitive Intel Built Into Every Move.

You don’t just know where you’re building. You know who else is building there, when they started, how fast they’re moving. That’s not just awareness—that’s positioning.

Bottom line: whether you’re raising capital, optimizing a portfolio, or planning a build, geospatial data analytics gives you fewer surprises, faster insights, and stronger margins.

If you’re not using it, you’re likely competing against someone who is.

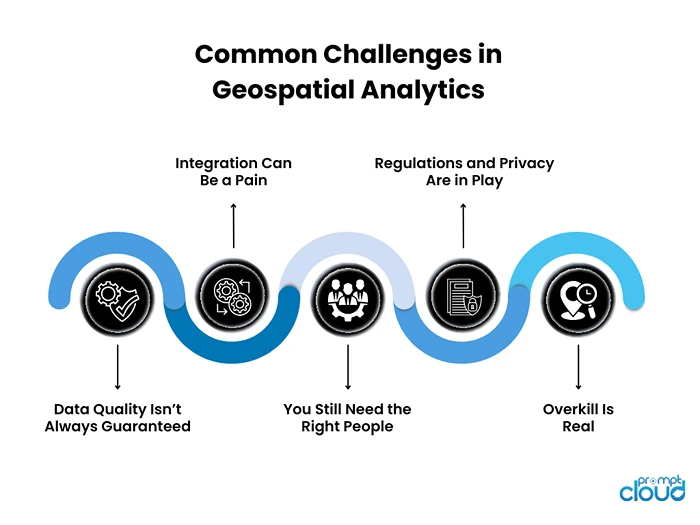

The Flip Side: What You Need to Watch Out For

Geospatial analytics is powerful—but it’s not plug-and-play. If you’re building this into your real estate strategy, here’s what to keep your eyes on:

Data Quality Isn’t Always Guaranteed

Not all datasets are created equal. Some are out of date. Others have poor resolution or inconsistent coverage. If you’re working with satellite imagery from three years ago, you’re not forecasting—you’re storytelling. Make sure your sources are recent, reliable, and verified.

Integration Can Be a Pain

Adding geospatial data to your existing analytics stack sounds great—until your platforms can’t talk to each other. Many real estate firms still run on a patchwork of tools. Getting your GIS data to sync cleanly with your financial models or CRM can take more time (and budget) than you planned for.

You Still Need the Right People

The best insights don’t come from the data—they come from asking the right questions. If no one on your team knows how to frame spatial questions or read imagery with context, all the dashboards in the world won’t help. You don’t need a 10-person data science team, but you do need at least one person who gets it.

Regulations and Privacy Are in Play

If you’re working with mobile location data or behavioral overlays, be careful. The line between public spatial data and personally identifiable information (PII) can blur fast. And depending on where you’re operating, there may be legal implications, especially in markets with strict data protection laws.

Overkill Is Real

Just because you can map it, doesn’t mean it’s useful. Some teams go overboard with layers, models, and historical data. The result? More noise, not more insight. Use what helps you make a decision. Leave the rest.

None of these are dealbreakers. But they’re real. And if you want to get the most out of geospatial analytics in real estate, you have to treat it like what it is: a strategic capability, not just another dashboard.

Turning Location into Leverage

Here’s the reality: the real estate world is shifting—from reactive to predictive, from gut instinct to data-backed strategy. And geospatial analytics is right at the center of that shift.

It’s not a trend. It’s infrastructure.

Whether you’re making multi-million-dollar development calls or trying to outpace your competition in a crowded metro, location intelligence gives you the kind of edge that used to take years of insider access to build. Now it’s in your hands—if you know how to use it.

But here’s the key: the advantage doesn’t come from having the data. It comes from knowing what to do with it. Knowing what to track. What to ignore. When to act. That’s where strategy lives now—not in hunches, but in visibility.

At PromptCloud, we help real estate firms, investors, and PropTech startups pull structured, location-based insights from messy, unstructured sources. Whether you’re building custom datasets, layering in geospatial feeds, or looking for portfolio-scale intelligence, we’ve got the tools to get you from data to decision.

The future of real estate isn’t just about what’s built. It’s about where, when, and why. With the right data, you don’t follow the market. You move ahead of it.

Curious what this could look like for your team? Schedule a quick demo or contact us to start the conversation.