**TL;DR**

If you work with stock market data, you already know how frustrating it is to rely on generic APIs. They’re fine for basic info, but when you need something more reliable, flexible, or tailored for serious analysis, they usually can’t keep up. PromptCloud solves that.

We pull stock data directly from live sources online, not just one or two feeds. Our setup is built to scale, so whether you need hundreds of tickers updated hourly or want to track specific data points across global markets, we can handle it. What makes it useful is that it’s not rigid. You don’t have to work around a fixed system. You tell us what kind of stock data you’re after, how often you need it, and the format that fits your setup.

It’s not some plug-and-play tool built for the average use case. Think of it more like building your own feed, one that fits your workflow. Fast, clean, and dependable.

Why Businesses Rely on Clean and Timely Stock Data

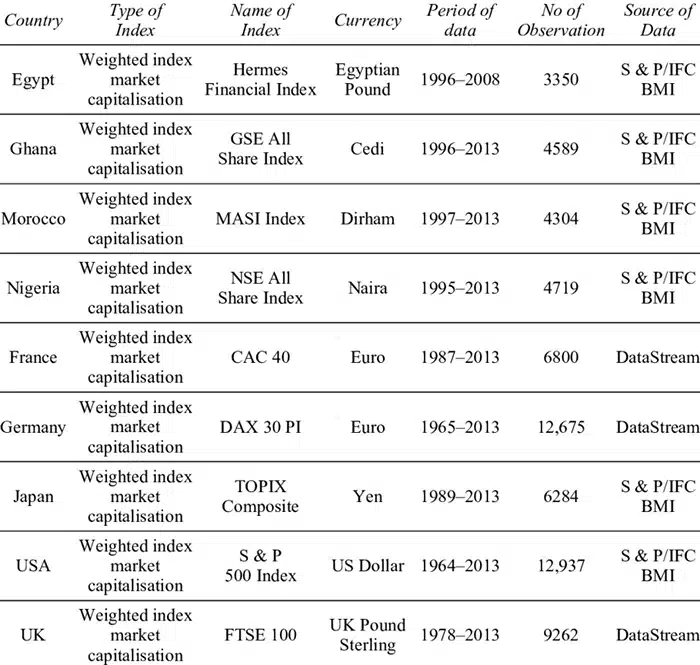

Image Source: Researchgate

The stock market doesn’t sleep. Markets change fast. One news headline or a post online can flip the investor mood in minutes. If you’re late catching that, even by a little, it can cost you. That’s why real-time stock data isn’t just helpful, it’s something most teams can’t really work without anymore.

Whether you’re running a fintech app, building investment models, or managing a portfolio, the quality of your decisions depends on the quality of your data. And not just any data, but the kind that’s timely, relevant, and detailed enough to work with. Unfortunately, a lot of the sources people start with, like Google Finance or Yahoo Finance, are either limited, delayed, or don’t give you the full picture.

At the same time, there’s no shortage of raw data floating around. There’s no shortage of stock-related info out there. You’ve got data coming from exchanges, news sites, forums, and even company blogs. But pulling all of that together, keeping it updated, and actually making sense of it? That’s where most teams run into trouble. It’s messy, time-consuming, and not something you want to be fixing every day.

That’s where PromptCloud comes in. We don’t just hand you stock data; we help you build a reliable system to gather it from the web in real time, in exactly the way your team needs. If stock market data is the engine that powers your product or strategy, think of us as the infrastructure that keeps it running smoothly.

The Problem with Traditional Stock Data Sources

A lot of people start with tools like Yahoo Finance or Google Finance just because they’re right there and don’t cost anything. It makes sense at first; they’re quick to try out, and you can grab some basic numbers without jumping through hoops. But if you’re building anything serious, something that actually depends on large volumes of reliable stock data, these sources tend to fall short.

They Don’t Let You Do Much Beyond the Basics

Let’s say you’re tracking a few tickers for fun or just pulling daily stock prices. No big deal, those APIs will work fine. But once you start needing things like international coverage, dividend histories, or detailed financials, they hit a wall. You can’t ask for what they don’t already offer. And if you need data from lesser-known exchanges or specific sectors, forget it.

Lag That Can Catch You Off Guard

Some platforms say their data is “real-time,” but it’s not always true. There’s usually some kind of delay, only it’s not clear how much. If your setup depends on reacting fast, even a small gap in timing can throw things off. Sometimes you won’t even realize there was a lag until the data feels off or you miss a move in the market.

Rate Limits Can Slow You Down

With many APIs, there’s a hard stop on how much data you can pull each day. That’s fine when you’re testing things out. But if you’re running real simulations, tracking lots of tickers, or updating dashboards often, you’ll probably hit those limits fast. It just gets frustrating after a point.

Getting the Data Is One Thing, Making It Useful Is Another

Even when you can grab the data, it’s not always in a shape that works for you. Maybe the format doesn’t match what your system expects. Or you must clean it up every time before it fits. So instead of spending time on analysis, you’re stuck just getting the data into usable form.

You’re Left Guessing When Things Go Wrong

When you use someone else’s stock data feed, you are sort of in the dark. You can’t see how they collect the data or how often they update it. If something’s off, like prices not matching or numbers disappearing from your app, you don’t really have a way to fix it. You just wait and hope it sorts itself out.

Why PromptCloud is the Best Web Scraping Service for Stock Data

When people hit the limits of stock APIs, they usually start looking for something more flexible, something that can scale with their data needs. That’s where PromptCloud comes in. We’re not another plug-and-play tool. What we offer is a service built around your specific data requirements, especially if you’re dealing with stock market data on a large scale.

Built for Custom Stock Data Needs

Not every team needs the same data. Some want live pricing from global exchanges. Others are more focused on earnings announcements, analyst ratings, or company filings. With PromptCloud, you don’t have to adjust your goals to fit someone else’s API. You just tell us what data you need, where it lives online, and how often you want it, and we handle the rest.

Scales Effortlessly

One of the hardest things about stock data is keeping it running at scale. You might start with 20 tickers, then move to 200 or 2,000. Our systems are designed to grow with you. Whether you’re tracking one sector or pulling data from multiple international sources, we make sure it keeps flowing without breaking or slowing down.

Structured Delivery in Your Format

We don’t send you raw dumps or files you have to fix up. The stock data we deliver is clean, well-organized, and formatted the way your systems expect it. Want JSON? You got it. Need a nightly batch in CSV, or prefer API delivery with webhooks? We’ll set it up that way. The idea is to take that whole cleanup step off your plate so your team can get right to work.

Reliable and Monitored

We keep a close eye on all data flows. If a source changes its structure or goes offline, we catch that quickly and fix it before it becomes your problem. This kind of monitoring is something that generic stock data tools don’t offer, and it’s what keeps our clients coming back. You get stock market data that doesn’t just look right, but stays consistent over time.

How PromptCloud Delivers Timely and Accurate Stock Market Data at Scale

Getting stock market data from the web sounds simple until you try to do it at scale. Between changing site layouts, different time zones, data formats, and the need for speed, things can get messy fast. We’ve built PromptCloud to take care of all of that, so you don’t have to.

We Scrape Data Directly from the Source

Unlike APIs that give you a filtered version of the truth, we go straight to the websites where the data is first published. That could be stock exchange sites, company investor pages, financial news portals, or market blogs. The benefit? You get exactly what’s out there—no filters, no middlemen, no guessing.

Real-Time or Regular Feeds, You Pick

Some clients want updates every few seconds, others need a nightly dump. Either way, we adjust the frequency based on your workflow. Need tick-by-tick updates from a major index? Done. Want to track closing prices for 800+ stocks in one go every day? That’s easy too.

We don’t force you into a preset schedule. You tell us when and how often—and we stick to it.

Data Comes Clean and Ready to Use

One of the biggest time sinks for most teams is cleaning up scraped data. We take care of that upfront. You won’t be digging through half-empty rows, broken columns, or weird symbols. Everything comes structured, checked, and aligned with your format needs—whether that’s flat files, cloud delivery, or direct API integration.

We Monitor Every Pipeline

Websites change. It’s just a fact. A table might get moved, a label might disappear, or a new format might roll out. When that happens, most scrapers break. What we’ve done is build constant monitoring into every job. So if a page changes or a value drops off, we know, and we fix it before it becomes your problem.

Scalable Without Stress

Whether you’re watching 50 tickers or 5,000, our infrastructure can handle the load. We’ve set up things so you can increase your data pull as your needs grow, without rebuilding your workflow from scratch. More volume doesn’t mean more complexity on your end.

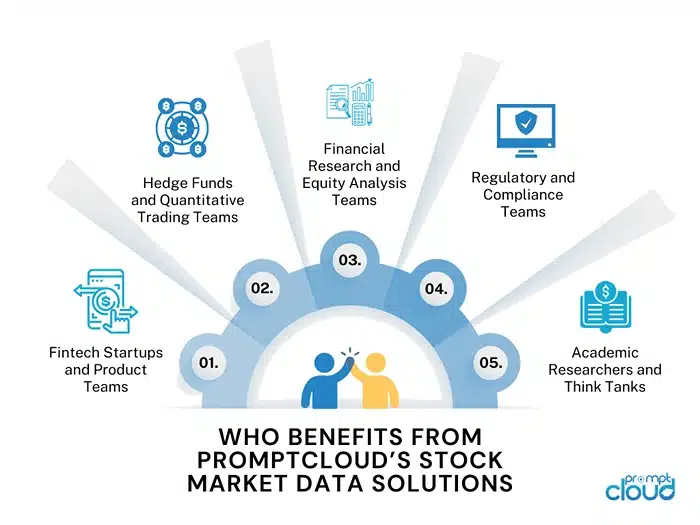

Who Benefits from PromptCloud’s Stock Market Data Solutions

You don’t need to be a trader sitting in front of a Bloomberg Terminal to care about stock market data. These days, accurate, real-time, and large-scale stock data powers decisions across a wide range of industries, from finance to tech, even media and academia. At PromptCloud, we’ve worked with a variety of teams, all using the same raw material—stock data—in very different ways.

Fintech Startups and Product Teams

Startups building finance-focused products, like investment apps, robo-advisors, or portfolio dashboards, need a steady flow of clean, timely stock data. Most start with free APIs, but they hit limitations pretty quickly. Whether it’s expanding to global exchanges or pulling in detailed financials, that’s where PromptCloud becomes the better fit.

We’ve helped teams pull in everything from dividend calendars to insider trades, formatting it for direct use in apps without any cleanup needed on their end.

Hedge Funds and Quantitative Trading Teams

For hedge funds running fast, algorithm-driven strategies, data speed, and accuracy aren’t negotiable. Even a slight lag can throw off performance. Some teams ask us for live pricing from dozens of exchanges. Others want real-time sentiment scraped from financial blogs or breaking news headlines.

We’ve built setups that support second-by-second updates, with built-in monitoring to make sure nothing slips through the cracks.

Financial Research and Equity Analysis Teams

Analysts producing deep reports, running forecasts, or benchmarking companies need historical data more than real-time speed. For these teams, context matters—quarterly trends, valuation changes, P/E movement across sectors. PromptCloud helps them pull structured data from a mix of sources like investor portals, filing repositories, and news archives.

We’ve also worked with boutique research firms that needed multi-year data across hundreds of tickers, all standardized and delivered in easy-to-load formats.

Regulatory and Compliance Teams

Some firms aren’t using stock data to trade—they’re using it to monitor. For example, a regulatory tech (RegTech) firm we worked with needed to track unusual price spikes and cross-check them against press release timestamps. PromptCloud helped set up a system to scrape and sync both data types automatically.

In a world where market abuse rules are tightening, having the right data at the right time can save a lot of trouble.

Academic Researchers and Think Tanks

Universities, research labs, and economic institutes often run large studies on financial markets. Their needs can include data from specific sectors, emerging markets, or long-term historical feeds not easily found in public datasets. We help them gather clean, reliable stock data for use in models, whitepapers, or academic journals.

We’ve supported PhD projects, government-funded studies, and even classroom tools that rely on regularly updated financial data.

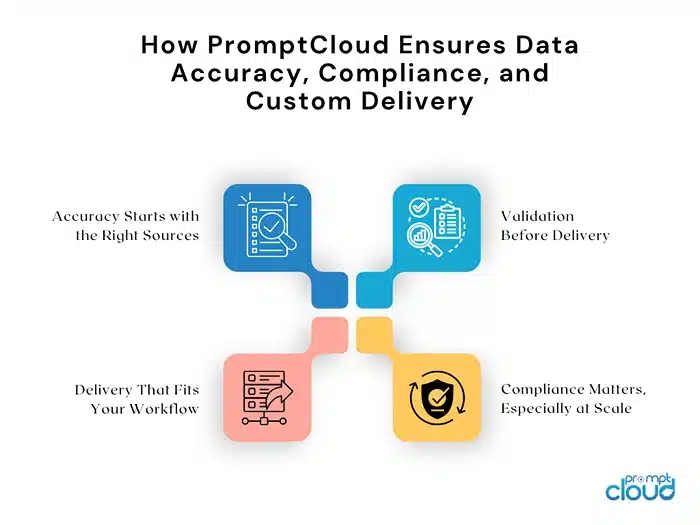

How PromptCloud Ensures Data Accuracy, Compliance, and Custom Delivery

When it comes to stock market data, speed is important, but accuracy and reliability are non-negotiable. If you’re making decisions or feeding data into a product, one wrong number can do real damage. We’ve built our entire approach at PromptCloud around getting this part right, every single time.

Accuracy Starts with the Right Sources

We don’t just pull data from wherever it’s available. Before anything is scraped, we work with clients to identify reliable sources, stock exchanges, company investor pages, well-known news outlets, and more. This helps us avoid noise and makes sure the data you’re getting is close to the source.

We’ve seen clients come to us after using low-cost scrapers or feeds that pulled from unreliable forums or aggregators. It doesn’t take long for that kind of data to cause problems. By going straight to trusted sources, we help avoid that altogether.

Validation Before Delivery

We don’t just scrape the data and send it your way. Before anything reaches you, we take time to go through it. If a value looks strange, say a stock price jumps way more than expected, we catch that early. We also check for missing pieces or weird formatting issues. And if your team has specific things you want flagged or filtered, we can build that in too.

In short, we clean it so you don’t have to.

Delivery That Fits Your Workflow

There’s no point getting clean stock data if you have to rework it every time just to make it usable. That’s why we offer flexible delivery options. Need data dropped into an S3 bucket? No problem. Want a secure API endpoint you can ping for the latest batch? We’ll set that up. Some clients even ask for FTP or Google Drive; whatever works best for your system, we support it.

And if your needs change, we’re flexible there too.

Compliance Matters, Especially at Scale

When scraping financial data, we follow industry best practices. That includes honoring site terms of use, throttling our crawlers to avoid overloading servers, and adjusting to any changes in the site’s structure or policies.

We’ve worked with enough enterprise clients to know how critical compliance is. Some even need data audit trails, version control, or reports on collection history. We can support all of that when needed.

Case Study -Scaling Stock Data for a Global Fintech Client

A few years back, we were approached by a fast-growing fintech. They were building a stock research platform aimed at both retail investors and small advisory firms. At the start, they were pulling stock data using a mix of free APIs and one paid provider. Things were working fine, until they weren’t.

As they added more features and expanded their coverage to include multiple international markets, their data needs grew fast. They wanted to track over 2,000 stocks, pull in quarterly earnings, company announcements, and price changes, along with analyst opinions and dividend histories. And they needed this refreshed several times a day, in multiple formats, for different parts of their platform.

The Challenge

The main issue wasn’t just volume, it was flexibility. Their internal tools needed different types of data delivered in different ways. One team wanted raw JSON for analytics, another needed flat CSV files, and their frontend engineers wanted live endpoints for in-app stock widgets. The tools they were using couldn’t keep up.

What We Did

We started by helping them identify all the websites they needed to pull from, official exchange sites, investor relations sections, and trusted financial news portals. Then, we set up a pipeline that scraped each data type at the frequency they needed. Some data came in every 15 minutes, some only once a day.

To keep things simple on their side, we built a system that sorted, validated, and delivered the cleaned data in whatever format each team wanted. Everything ran in parallel, with error alerts set up just in case anything looked off.

The Result

Within weeks, they stopped relying on their patchwork of old APIs and data tools. The feeds we provided now power their platform’s core features, real-time charts, earnings dashboards, and company profiles. Because everything’s automated and monitored, their engineering team doesn’t have to worry about it breaking.

They’ve since expanded their coverage again, doubling the number of tickers, and the system we built for them just scaled with it.

So, Is PromptCloud the Right Fit for Your Stock Data Needs?

If you’re working on anything that depends on stock data, whether it’s a trading app, research dashboard, or something more complex, there’s a point where off-the-shelf APIs just won’t cut it. You need flexibility. You need updates you can count on. And you need control over how the data shows up.

That’s where PromptCloud makes a difference. We’re not handing you another generic feed. What we offer is a data setup built around what you need, whether that’s scraping public company announcements, monitoring live market movements, or pulling earnings data across hundreds of tickers.

Everything we deliver is structured, monitored, and ready to plug into your system. And if something breaks, we fix it, no long wait times or support tickets lost in a queue.

At the end of the day, the more control you have over your stock market data, the more confident you’ll be in the decisions or tools it powers. We help you get that control and keep it. Reach out to us today!

FAQs

1. What’s the best way to collect large volumes of stock data?

Depends on what you’re after, honestly. If it’s just a few tickers, maybe an API will do. But when you need more, like historical data, multiple exchanges, or updates every few minutes, those tools usually don’t hold up. Scraping directly from websites gives you more room to build exactly what you need, especially at scale.

2. Why is real-time stock data so hard to get right?

A bunch of reasons. First, most public sites aren’t actually “live” even if they say they are; there’s usually a delay. Then there’s the issue of volume. Trying to get a lot of updates, quickly, without things breaking? That’s the tricky part. And if the source changes anything on their end, your whole setup can fall apart unless you’re watching it closely.

3. Is free stock market data enough for serious analysis?

It works to a point. If you’re doing light research or testing a basic idea, it might be fine. But when the stakes go up, say you’re trading, building tools for others, or running deeper models, that’s when the cracks show. You start seeing gaps, mismatched formats, or lagging numbers. That’s when people usually start looking for something more reliable.

4. What kind of data should I track beyond stock prices?

That’s gonna depend on what you’re trying to learn or build. Some folks care about earnings or dividends, others are tracking things like analyst comments or even social sentiment. For more complex stuff, like forecasting or investment strategy, you’ll usually want a mix of raw numbers and context, like news headlines or event data.

5. Can I use scraped stock data legally?

Short answer: sometimes. A lot of sites post data in public, but that doesn’t always mean you can reuse it however you want. If it’s just for internal analysis, most people are fine. But if you’re redistributing the data, selling access, or building a public-facing tool, you really need to check the site’s terms. Always better to be cautious.