Cars aren’t just machines anymore. They’re computers on wheels. And with every trip, they’re collecting loads of information, speed, fuel efficiency, tire pressure, GPS movement, driver habits, and more. That pile of numbers? It’s what the industry now calls cars data, and it’s quickly becoming the thing that separates the leaders from the ones just trying to keep up.

We’re not just talking about data coming from inside the car. There’s also a goldmine of automobile data scattered across the internet, from dealership listings and pricing info to customer reviews and real-time inventory. Smart companies are using tools like automobile data scraping services to collect all this public data at scale and make sharper decisions, faster.

So why does all this matter? Because the stakes are high. Building a better car isn’t just about engineering anymore, it’s about understanding the market, your customers, and your competition. And that’s where data analytics in the automobile industry comes in. When used right, it can improve everything from production planning to customer satisfaction.

In this piece, we’re going to walk through how data is completely reshaping the auto world, from the kind of information companies are collecting, to how they’re using it to stay one step ahead. Whether you’re a product guy, a data nerd, or just someone trying to figure out how to future-proof your automotive business, you’re in the right place.

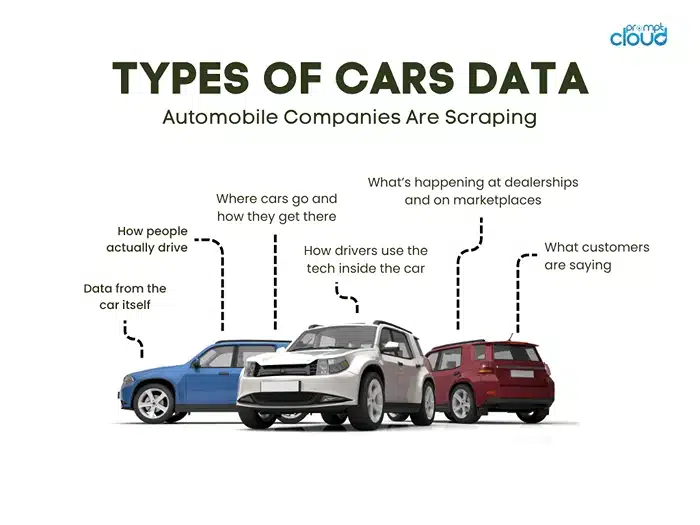

What Types of Cars Data Are Automobile Companies Collecting?

Let’s start with the basics: what exactly do we mean when we talk about “cars data”? It’s not just a buzzword. It’s the raw material that’s helping car companies build smarter strategies, better products, and stronger connections with customers. Whether it’s coming from inside the vehicle, from connected devices, or scraped from public websites, this data is incredibly valuable when you know what to look for.

Here’s the kind of cars data that’s being gathered right now—and why it’s such a big deal.

Data from the car itself

Today’s cars are loaded with sensors. They track engine performance, fuel usage, tire pressure, even how hard you slam on the brakes. Manufacturers use this info to figure out what’s working, what’s about to break, and how to improve the next version of the car. It’s also handy for spotting issues before they become recalls. That’s a win for everyone.

How people actually drive

Cars with connected systems can now tell how the driver behaves—whether they’re always speeding up fast, braking late, or cruising slow in the left lane. This data helps insurance companies come up with smarter rates. But it also helps automakers build cars that fit real-world use, not just lab conditions.

Where cars go—and how they get there

GPS data gives insight into driving routes, traffic hotspots, and which areas see the most wear and tear. If a car company knows that most of its customers are driving on rough roads in city traffic, that changes how they think about suspension, durability, and even fuel economy.

How drivers use the tech inside the car

Voice commands, app usage, music preferences—every time someone interacts with the infotainment system, it’s logged. And that tells automakers a lot about what people care about inside the car. If no one’s using a certain feature, maybe it’s time to kill it. If one gets a lot of love, maybe it deserves more real estate on the screen.

What’s happening at dealerships and on marketplaces

This is where things get really interesting. A lot of companies are using automobile data scraping services to pull data straight off public websites. That includes car dealer pages, online marketplaces, and classified sites. By scraping all this automobile data, they can track:

- What prices are being listed (and where)

- Which models are selling fast (and which are sitting)

- What kinds of offers or discounts dealers are pushing

- How inventory is moving across regions

That’s incredibly useful if you’re trying to stay competitive. You don’t have to guess what the market’s doing—you can see it, live, in your dashboard.

What customers are saying

There’s no shortage of online reviews. People are talking about their cars constantly—on dealership sites, Reddit threads, car forums, and review platforms. With website data scraping services, companies can collect all those opinions and run sentiment analysis. What are people raving about? What’s bugging them? That kind of real-world feedback can be more honest—and more helpful—than a carefully worded survey.

So, why does any of this matter?

Because this data helps companies make smarter calls. They can build better vehicles, manage supply chains more efficiently, and give customers exactly what they want—without guessing. Whether it’s pulled from a sensor inside the engine or scraped off a review site, cars data is what keeps the best companies one step ahead of the rest.

How Web Scraping Automobile Data Actually Gives You an Edge

Here’s the thing: the auto industry is flooded with data. Every car listing, every dealership site, every customer review—it’s all out there in the open. The smart companies? They’re not just watching it; they’re collecting it, organizing it, and using it to make better decisions, faster. That’s what web scraping automobile data is all about.

And no—it’s not shady or illegal. It’s simply about pulling public info from websites in an automated, structured way. The kind of stuff you’d normally check manually, but at a scale no human team could keep up with.

Let’s say you want to track how car prices are shifting across different cities. Or see which models are selling fast on platforms like Autotrader, CarDekho, or local dealer sites. With automobile data scraping services, you can get all that—every single day, without lifting a finger.

Here’s how that gives you a real advantage:

You don’t have to guess what the market is doing

Say your competitor quietly drops the price of their hybrid SUV in three major cities. If you’re scraping listings across those regions, you’ll catch that move in near real-time. That means you can respond quickly—adjust your own pricing, shift your ad strategy, or prep your sales team before it even makes headlines.

You see real demand—not just forecasts

Want to know which trims are going out of stock fastest? Or what optional features people are paying extra for? That kind of pattern isn’t obvious until you look at large volumes of cars data from multiple sites. Web scraping helps you spot what’s trending—by brand, by body type, even by color.

You understand what customers actually care about

Online reviews are brutally honest—and full of insight. When you scrape and analyze thousands of them, you start to notice what customers repeatedly praise or complain about. Maybe they’re fed up with clunky touchscreens. Maybe they love the fuel economy of a new engine type. Either way, that’s feedback you can’t afford to ignore.

You stay competitive—even without a huge team

This isn’t just for the big players. Smaller automakers, used car platforms, even regional dealerships can use automobile data scraped from public sites to keep tabs on market pricing, stock movement, and promotions. It’s like having your own intel team—without the overhead.

You stop wasting time on gut decisions

When you’ve got clean, structured, up-to-date data from the web, it becomes a lot easier to make smart choices. You can spot underperforming dealers, see which models are losing momentum, or identify where demand is heating up. That kind of visibility cuts out a lot of guesswork.

So no, web scraping isn’t about collecting data just for the sake of it. It’s about building a clear, unbiased view of what’s happening in your market right now. And when you have that kind of insight, you’re not playing catch-up—you’re setting the pace.

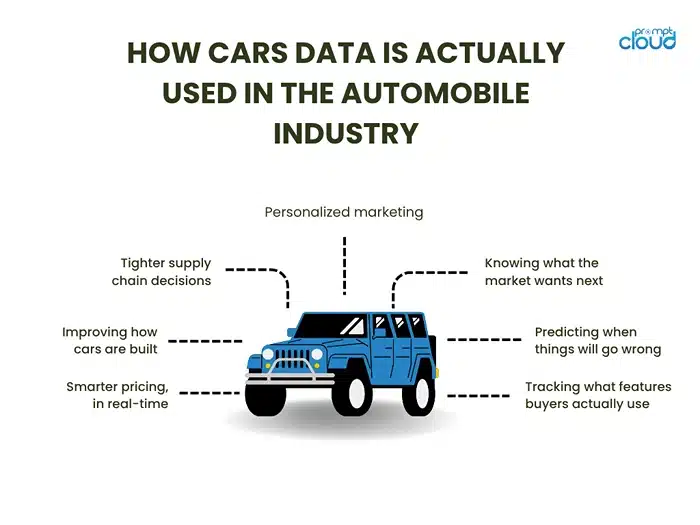

How Cars Data Is Actually Used in the Automobile Industry

It’s one thing to talk about how valuable cars data is. But let’s get real—what are auto companies actually doing with it? Not hypothetically. Not in some future case study. Right now.

Here are a few real-world ways data analytics in the automobile industry is reshaping the game:

Smarter pricing, in real-time

You know how some car prices seem to shift overnight? That’s not random. That’s data at work. By scraping prices across hundreds of dealership and marketplace sites, automakers and dealers can spot when a competitor adjusts their rates—and react instantly. No waiting for monthly sales reports. No guesswork. Just real-time intel that helps you stay sharp.

Improving how cars are built

Engineers aren’t just relying on lab tests anymore. They’re pulling in live telemetry data from vehicles already on the road—engine health, battery performance, braking patterns, the whole thing. When they see, for instance, that a component wears down faster in extreme heat, they redesign it. Simple. That’s how data quietly shapes every new model launch.

Predicting when things will go wrong

Preventive maintenance isn’t about magic—it’s about patterns. If thousands of cars with the same make and model all start showing brake wear at 30,000 kilometers, guess what? You’ve got a known weak spot. Data analytics lets service teams know what to expect before the customer calls in angry.

Tracking what features buyers actually use

Car brands are obsessed with new tech. But not everything lands. When connected cars report back that barely anyone’s using gesture controls, or everyone’s blasting Apple CarPlay 24/7, that’s a sign. Automakers can drop the gimmicks and double down on what drivers actually care about.

Knowing what the market wants next

This is where web scraping automobile data really shines. If you’re pulling listings and tracking which trims are sold out week after week, that’s a strong demand signal. If a wave of online reviews starts mentioning “needs better EV range,” there’s your product roadmap. This kind of automobile data doesn’t lie. It shows you what’s missing—and what’s about to matter.

Tighter supply chain decisions

The old way? Ship 500 sedans to every region and hope for the best. The new way? Use scraped marketplace data and dealer inventory feeds to see where those sedans are actually moving. Maybe Delhi’s overloaded but Pune’s out of stock. That kind of visibility helps you move faster and smarter.

Personalized marketing

Everyone hates generic car ads. When marketers plug into the right data—from online searches, listings, and even scraped reviews—they can get laser-specific. Someone in Bengaluru searching for second-hand hybrids should not be seeing ads for luxury SUVs. Good data kills bad targeting.

Cars data isn’t just sitting in spreadsheets—it’s actively shaping what’s getting built, where it’s getting sold, and how it’s being marketed. And if you’re not using it, your competition definitely is.

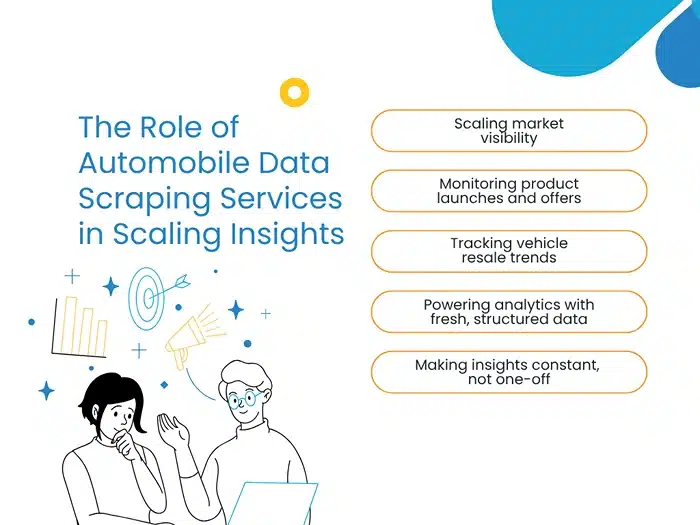

The Role of Automobile Data Scraping Services in Scaling Insights

Let’s face it: most auto companies are sitting on a mountain of internal data—sales logs, service records, CRM inputs, you name it. But that’s only half the story. The real edge? It comes when you match that up with what’s happening outside your company—on the internet, in real time. And that’s exactly what automobile data scraping services are built for.

These services don’t just pull data. They pull the right data, clean it, structure it, and deliver it in a format your team can actually use. No digging through PDFs or copying from spreadsheets. No wasting time figuring out if two listings are for the same variant. Just clean, up-to-date cars data delivered like clockwork.

Here’s where that becomes a game changer:

Scaling market visibility

If you’re only watching five competitor websites, you’re missing the big picture. But manually tracking 500 dealer listings across cities and marketplaces? Forget it. With scraping, you scale instantly. You get price trends, stock movements, and regional demand across thousands of sources—daily or even hourly.

Monitoring product launches and offers

Say a rival just launched a mid-range EV with a promo in Tier 2 cities. Scraping services can catch that. Not just the product specs, but the price points, dealer availability, bundled features, and customer reviews from day one. That gives your product and marketing teams a serious head start.

Tracking vehicle resale trends

Second-hand markets are often a goldmine for insights. If certain models are holding their value better—or losing it fast—there’s a reason. Web scraping pulls data from resale listings, helps you understand depreciation patterns, and can even inform future warranty terms or trade-in programs.

Powering analytics with fresh, structured data

You don’t need to build a scraping engine from scratch or throw engineers at it full-time. That’s what website data scraping services are for. They handle the messy part—IP rotation, bot detection, parsing inconsistent layouts, so your team can focus on actually analyzing the data, not collecting it.

Making insights constant, not one-off

Anyone can run a one-time market study. But scraping lets you turn that into an ongoing stream. You can track your competitors week by week. Watch how customer reviews shift after a model recall. Monitor how pricing evolves in the run-up to a festive season. It’s not a snapshot. It’s a live feed.

In short, automobile data scraping services are what allow serious companies to keep their edge without burning time or resources. It’s how you stop guessing, stop reacting late, and start making decisions based on what’s really happening in the market—right now.

Why Cars Data Is at the Center of the Future Automotive Ecosystem

The auto industry isn’t just building vehicles anymore, it’s building connected ecosystems. And at the core of all this change is one thing: data. More specifically, cars data that helps companies move faster, make better decisions, and design smarter products.

Vehicles today aren’t just machines, they’re data sources. Every time a car brakes too hard, takes a longer route, drains a battery quicker than expected, or sends an error signal, that information can feed back into how the company operates. But only if you’re set up to use it.

Connected cars are reshaping operations

Modern vehicles send back continuous data, engine health, location, user habits, system faults. This isn’t just helpful for servicing. It allows automakers to predict issues, push software updates, and even improve the next model based on real-world use. It’s closing the loop between what’s built in the factory and what actually happens on the road.

EVs need more than good batteries, they need good data

Electric vehicles are changing the rules. Charging behavior, battery cycles, climate impact on range—this is all data you can’t afford to ignore. The smartest EV makers aren’t just tracking their own performance. They’re pulling market-wide automobile data to understand usage patterns, charging demands, and where infrastructure is falling short.

Autonomous systems thrive on real-world feedback

Every self-driving system is only as good as the data it learns from. But even companies not in the AV space benefit from this. Whether it’s adaptive cruise control or advanced safety features, cars data collected from real driving conditions is powering faster, safer development.

Mobility platforms need visibility across the market

Rideshare, subscription services, logistics, these businesses rely on accurate, real-time market signals. Where is demand surging? What are competitors offering? How are prices shifting in different cities? That kind of insight doesn’t come from a spreadsheet. It comes from structured, up-to-date web scraping automobile data you can rely on.

Sustainability and compliance start with tracking

Green policies and regulations are getting stricter. To stay ahead, manufacturers need full visibility into their energy use, emissions data, sourcing patterns, and vehicle lifecycle performance. The companies that track this proactively, not reactively, are the ones that lead, not just follow regulations.

In the end, data isn’t just a layer on top of the automotive business anymore. It’s the base everything is built on. And the sooner companies start thinking that way, the better prepared they’ll be to compete, whether they’re building the next EV, improving urban mobility, or transforming the driving experience altogether.

Why PromptCloud Is the Right Partner for Automotive Data Scraping

By now, it’s clear: the automotive industry runs on data. But getting that data, cleanly, consistently, and at scale, isn’t easy. Websites change. Competitor listings vary by geography. Marketplaces list the same model in five different ways. Manual tracking is time-consuming. And in-house scraping is messy, expensive, and rarely future-proof.

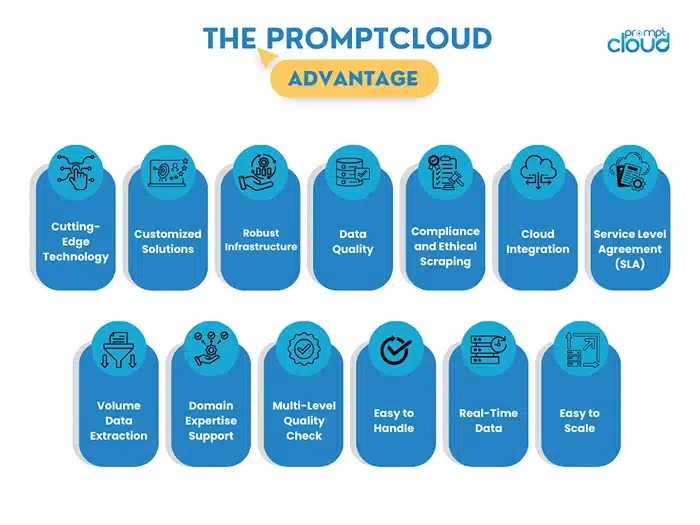

That’s where PromptCloud comes in.

We specialize in website data scraping services built for scale. Whether you need thousands of vehicle listings from used car platforms, live pricing from OEM and dealership websites, or reviews and specifications scraped from marketplaces and forums, we’ve done it. And we do it daily.

Here’s why our clients in the automobile sector trust us:

Customized scraping for automotive data

We don’t offer off-the-shelf dashboards with limited filters. We build dedicated pipelines tailored to your exact data needs, be it for price comparison, product benchmarking, tracking offers, or mapping resale trends across regions. Your cars data comes pre-cleaned, structured, and ready to plug into your systems.

Quality that doesn’t drop when sites change

Website structures change all the time. Our infrastructure adapts automatically, so your automobile data feed doesn’t break. You won’t wake up to missing data or broken code. We maintain it. You act on it.

Compliance-focused approach

Web scraping is powerful, but only when done responsibly. At PromptCloud, we follow all applicable data privacy and legal guidelines. We don’t cut corners. We work with you to make sure your data pipeline is both effective and compliant.

Scale, speed, and support

Whether you’re tracking 100 models or 10,000, we scale without delay. Our support team works with your analysts and data science teams to ensure delivery formats, frequency, and fields are aligned with your workflows. This isn’t a one-time scrape, it’s a long-term data partnership.

In a space where the competition is fast, and the market moves faster, good data isn’t a luxury, it’s a necessity. PromptCloud gives you the confidence to make decisions based on what’s really happening out there: in dealerships, on marketplaces, across regions, and in real time.

If you’re looking to turn raw web data into meaningful market insight, we’re built for exactly that. Let’s talk.