Every end of the year calls for a new budget for companies. Some firms like to revise their budgets quarterly or even monthly depending on the actuals vs the forecast. For bootstrapped companies, who are quite keyed up to increasing profit margins and keeping expenses in check, here’s a short guide to budgeting for the next year.

0. Revenue Goals

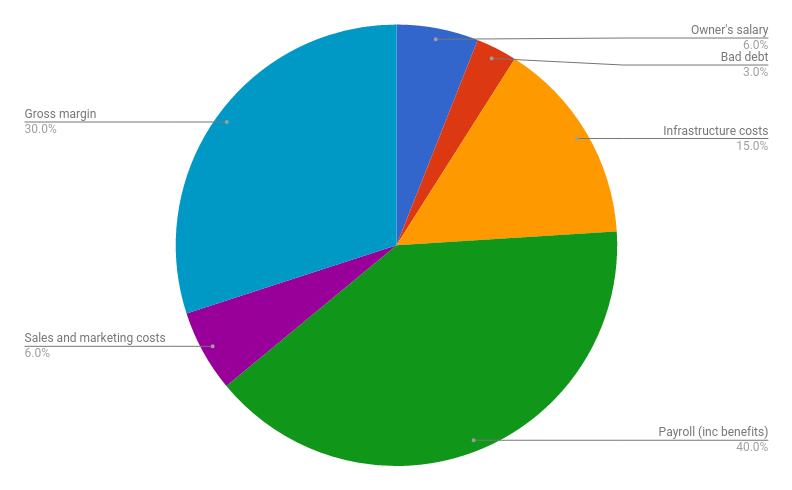

Take current year’s revenue as the anchor to allocate budget for various departments. Budgets are usually directed by company goals for the year. For purposes of illustration, let’s set the premise of a typical SaaS with a goal of 30% gross margins and hence COGS shouldn’t be more than 70%. You can change these numbers as per the industry in concern. The lesser your profit goal, the more leeway you have to move that number into COGS.

1. Payroll (40%)

Not more than 40% of your annual revenue should go into payroll including employee bonuses and other compensation. This does not include sales and marketing compensation as they have to be accounted for separately for calculating CAC. Hiring budgets for the year can be derived from this head.

1A. Employee benefits and staff welfare (4% of payroll)

This includes all the festivity and carousal you’d like to undertake during the budget period be it free lunches, dinners, team outings. Factor in all the fringe-benefits like training, company sponsored cell phones, awards and employee insurance. All of these together shouldn’t be more than 4% of the actual payroll amount.

2. Sales and marketing (6%)

Allocate 6% here for sales and marketing salaries including incentives, subscriptions, tools, and any other services you’d use to attract prospects to your website.

3. Owner’s salary (6-15%)

Although it’s common to not draw any salary during initial years of your company, it’s not sustainable beyond a point if you rationalize with what you’d have made had you been working elsewhere. For a general B2B firm, that timeframe is usually 6 months – 2 years. Your struggle is worth if you’re drawing out atleast 6% of your gross revenue as your salary. It could be more depending on the health of your business.

4. Infrastructure costs and other expenses (15%)

There could be a lot of infrastructure and equipments involved in running your business, and hence costs will vary. However, they can generally be traded off with the payroll budget. Here, for purposes of a SaaS business that needs to commission servers and other cloud solutions, we’d set aside 10% of the annual revenue against this head, and another 5% for miscellaneous operational expenses.

5. Bad debt (3%)

Lastly, it’s equally important to account for bad debt, as not everything you’ve invoiced would be paid out due to collection issues, client’s company shutting shop and filing for bankruptcy, and so on. If you find your business losing out more than 3% in bad debt every year, your collection process needs a major fix. Moving to annual contracts or advance payments might be a good idea in that case.

Takeaway

Based on how often you prepare budgets, you could still use the above numbers to plan while moving the actual revenue back into the budget kitty. On a concluding note, as a bootstrapped company, it’s extremely important to keep monitoring these budgets from time to time. Build a culture where budgets are seen only as a guideline and each department spends money as its own as opposed to spending everything that has been allocated. These practices boost your runway that further fuels the growth engine and increase the lifespan of a company.