For decades, financial professionals have relied on the same core set of tools: earnings reports, SEC filings, interest rate updates, and quarterly guidance. These traditional data sources still matter. But in today’s markets, where speed, nuance, and early insight can separate winners from the rest, they’re no longer enough on their own.

That’s where alternative data comes in.

Unlike the standard reports everyone reads at the same time, alternative data offers something different: a way to see what’s happening beneath the surface, often before it shows up in the numbers. Think satellite images showing construction progress before a company announces a new facility. Or anonymized credit card data revealing a spike in retail sales weeks before an earnings call. Even something as simple as tracking app downloads can offer clues about a company’s momentum.

This kind of data isn’t pulled from balance sheets. It’s pulled from the real world, and it’s changing how smart investors operate.

Whether you’re managing a hedge fund, building models as a quant, or just looking for sharper insight, alternative data is no longer a nice-to-have. It’s becoming essential.

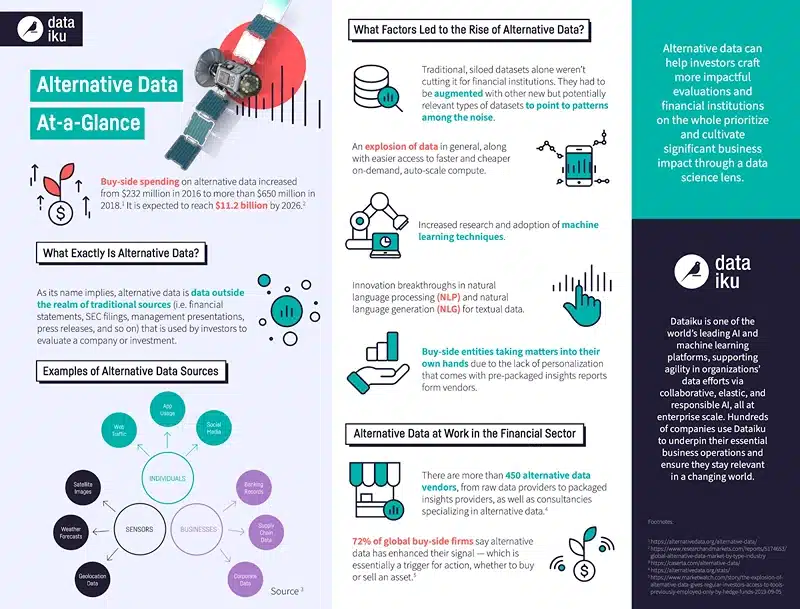

What Is Alternative Data?

Image Source: dataiku

If you strip away the buzz and the jargon, alternative data is exactly what it sounds like: information that doesn’t come from the usual financial sources, but can still tell you something valuable about a business, a market, or the economy.

We’re talking about data that wasn’t originally created for investment purposes. Things like satellite imagery, mobile app usage, online reviews, shipping logs, or even how many trucks are pulling into a company’s loading dock. On their own, these data points might seem random. But in context and with the right analysis, they can reveal trends, risks, and opportunities that traditional reports won’t show until it’s too late.

Let’s be clear: this isn’t about replacing balance sheets or income statements. Those are still foundational. But alternative data fills in the blanks. It answers the questions investors didn’t even think to ask.

Here’s a quick example: say a major retailer is set to report earnings in a few weeks. Traditional analysts wait for the call. But someone analyzing foot traffic data from mobile devices already sees a dip in store visits. Someone else sees that the company’s app downloads have dropped, or that online sentiment is starting to turn negative. That’s alternative data in action, giving you insight before the rest of the market catches up.

This is what makes it so powerful. It’s not just different. It’s faster. It’s more granular. And increasingly, it’s what separates reactive strategies from proactive ones.

Types of Alternative Data Used in Finance: Real Sources, Real Impact

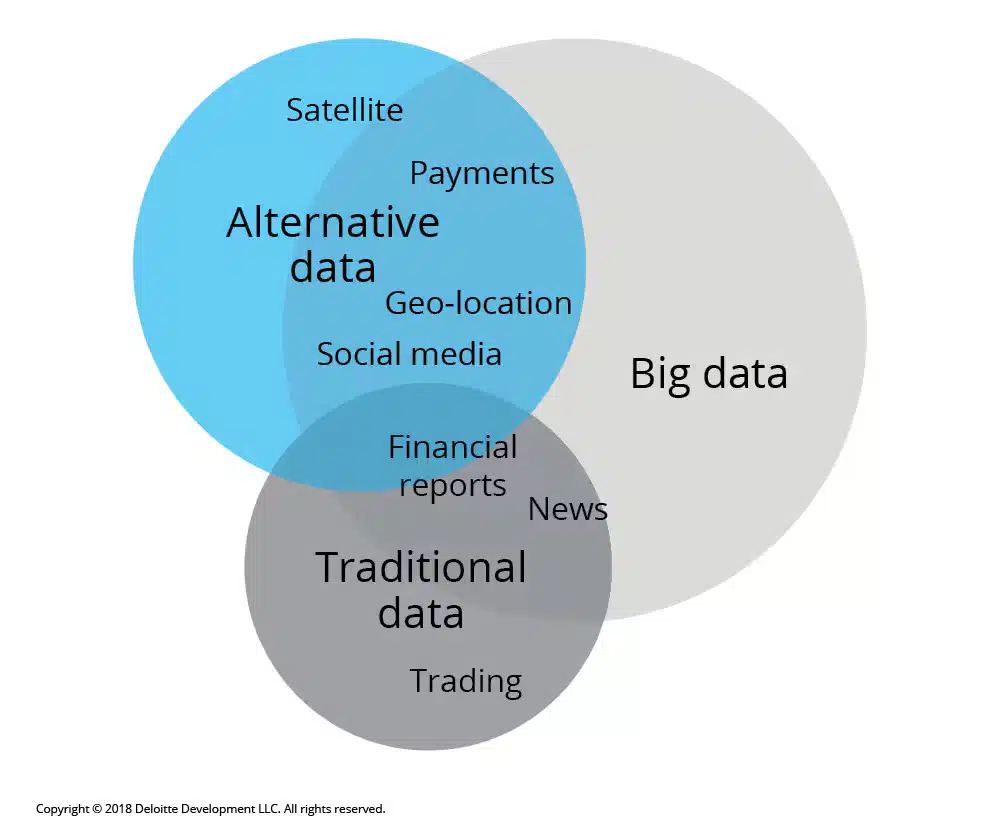

Image Source: Deloitte

Alternative data isn’t a gimmick, it’s a growing part of serious investment strategy. But not all alt data is created equal. What matters is how useful it is, how early it gives you a signal, and whether it actually ties to business outcomes.

Here are some of the key types of alternative data that investors are putting to work right now and why they matter.

1. Social Media and Online Sentiment

Markets are driven by perception as much as performance. Social media offers raw, unfiltered access to public opinion, whether it’s excitement about a new product, backlash over a brand scandal, or shifting attitudes on an entire sector.

It’s not about scrolling through Twitter manually. Sophisticated funds are using natural language processing (NLP) to analyze sentiment across millions of posts. If public mood around a stock starts to shift days before the price does, you want to be on the right side of that trade.

Reddit threads, influencer reactions, and review platforms have all become early indicators of market movement, especially in consumer-facing industries.

2. Satellite Imagery and Location Data

This isn’t science fiction, it’s become a surprisingly practical tool. Investors use satellite imagery to track inventory build-up, monitor crop health, or even count cars in parking lots.

Want to know how a retailer’s quarter is shaping up before earnings drop? Compare traffic at their top stores over time. Logistics and shipping data also fall under this category if fewer trucks are leaving a warehouse, that might tell you something the CFO hasn’t said yet.

Geolocation data from smartphones adds another layer. It’s anonymous, but it reveals foot traffic patterns, visit frequency, and regional activity. For physical businesses, that’s as close as you can get to watching operations in real time.

3. Web Scraped Consumer and Product Data

Web scraping gives investors a way to monitor the internet like a data feed. Whether it’s tracking product availability, pricing trends, app store ratings, or hiring patterns on company careers pages, it’s all public data if you know how to collect and structure it.

For example, if a travel platform is steadily raising hotel prices across major cities, that might indicate rising demand. If a startup’s website quietly pulls down its “We’re Hiring” page, that could point to trouble ahead. These micro-signals don’t show up in 10-Qs, but they show up here.

4. Transaction and Point-of-Sale (POS) Data

Credit card and debit data is one of the most direct ways to measure consumer spending. At scale, and when aggregated and anonymized properly, it can reveal category-level trends, brand-level shifts, and changing consumer behavior.

Funds use this data to track retail, hospitality, food delivery, and even healthcare activity. You’re not guessing how a company’s top line looks, you’re watching it unfold in real time.

It’s no surprise that many hedge funds treat access to POS and transaction data as a core part of their strategy.

5. ESG Signals from Alternative Channels

Environmental, Social, and Governance metrics are under more scrutiny than ever. But standardized ESG scores can be slow, inconsistent, or overly broad. Alternative ESG data goes deeper.

Investors now analyze things like employee reviews on job sites, social responsibility trends on news feeds, and environmental citations in public databases. These sources offer sharper, real-world signals about a company’s behavior and risk profile, long before the next ESG report is released.

In a market where capital is increasingly tied to values, this kind of data is driving both risk management and alpha generation.

How Alternative Data Helps Investors Gain an Edge

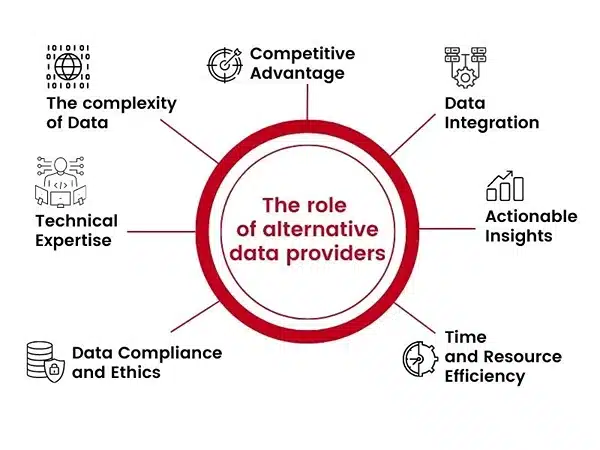

Image Source: PredikData

At its core, investing is about seeing what others can’t or seeing it earlier. That’s exactly where alternative data delivers. It’s not just about having more data. It’s about having different data, the kind that surfaces signals before they’re priced in.

Here’s how real investors are using alternative data to strengthen strategy and sharpen performance.

1. Better Market Predictions, Backed by Behavior

Traditional models rely heavily on historical data on what already happened. That’s fine for long-term trend lines, but not so great when you’re trying to understand what’s happening right now. Alternative data closes that gap.

Take geolocation data. If a retailer’s foot traffic drops 15% across key markets, and you’re seeing that two weeks before earnings, that’s actionable. Same with transaction data, if consumer spend is shifting from one brand to another in real time, you can adjust your exposure before the rest of the market catches on.

It’s not about replacing forecasting models. It’s about feeding those models better inputs.

2. Spotting Trends Before They Become Headlines

Markets reward early movers. Alternative data helps investors identify inflection points before they become obvious.

For instance, web-scraped data might show a sudden uptick in demand for a particular product category, long before the company officially reports strong sales. Or sentiment analysis could catch a positive swing in consumer perception while traditional analysts are still neutral.

These kinds of signals don’t scream from the front page. They whisper through the data if you’re listening.

3. Validating or Challenging Company Narratives

Public companies are in the business of managing expectations. That’s why earnings calls, investor decks, and forward guidance often paint an optimistic picture. But alternative data gives investors a way to independently verify the story.

Let’s say a company claims it’s gaining market share. Credit card data shows flat sales, web traffic is declining, and app downloads are down. That tells you something different and gives you a chance to rethink your thesis before the stock reacts.

This kind of independent validation is especially useful for short sellers, activist investors, and anyone managing concentrated exposure.

4. Building Differentiated Investment Strategies

In a crowded market, ideas get crowded too. If your research is based on the same datasets everyone else uses, your trades will look a lot like theirs. That’s a problem.

Alternative data creates space for unique views. Maybe your firm builds a strategy around pricing trends in online marketplaces. Maybe you use hiring data to anticipate R&D investments in biotech. Whatever the angle, alternative data lets you operate in a part of the information curve where fewer people are looking.

And in this business, differentiated insight is the first step toward differentiated performance.

The Growing Alternative Data Market: Where It’s Headed and What It Means for You

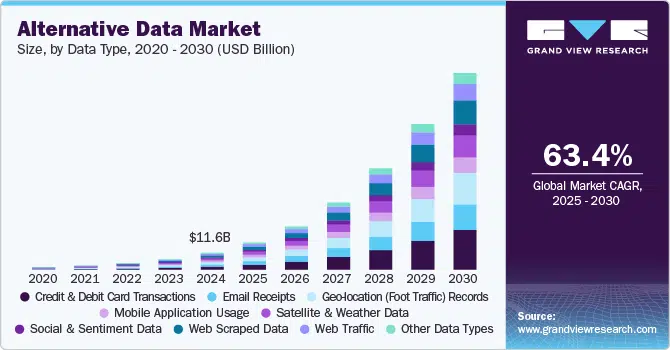

Image Source: Grand View Research

What started as a niche experiment for a handful of hedge funds has quickly become a full-blown industry. The alternative data market is now estimated to be worth over $4 billion, and growing fast. According to Grand View Research, it’s expected to expand at a compound annual growth rate (CAGR) of over 50% through the end of the decade.

But it’s not just the size of the market that’s interesting. It’s the way it’s evolving.

A Surge in Demand and Providers

Ten years ago, only the most sophisticated quant funds were using alternative data. Today, it’s on the radar of traditional asset managers, insurance firms, private equity, and even corporate strategy teams.

This surge in demand has led to a wave of new data providers offering everything from geospatial analytics to niche scraping services. The ecosystem is more mature now, but it’s also more crowded. Choosing the right provider and making sense of the raw data has become just as important as the data itself.

The Role of AI and Machine Learning

Most alternative data is unstructured. It’s messy, noisy, and often massive. That’s where machine learning and AI come into play.

These technologies allow investors to process thousands or millions of data points quickly and spot patterns the human eye would miss. NLP (natural language processing) helps scan social sentiment. Predictive models can find correlations between web behavior and stock performance. Clustering algorithms can sort retailers by foot traffic trends across geographies.

In other words, the value isn’t just in collecting alternative data. It’s in interpreting it intelligently.

Regulatory and Ethical Considerations

As with any edge, there’s a line, and smart firms know not to cross it.

The alternative data space has attracted scrutiny from regulators, especially when it comes to how data is sourced and whether it creates an unfair advantage. Using anonymized and aggregated data is standard best practice, but firms still need to vet providers carefully and understand the compliance implications.

Ethics also matter. Just because you can collect a certain dataset doesn’t mean you should. Investors who want to build long-term, sustainable strategies know this and make choices accordingly.

Integrate alternative data into your investment strategy

The question isn’t whether alternative data has a place in finance; it’s how well you’re using it.

In a world that moves faster than quarterly reports and demands more than surface-level insight, alternative data offers a real advantage. It helps you react faster, validate smarter, and invest with more conviction.

But the value isn’t just in having the data. It’s in how you collect it, clean it, and apply it to your strategy.

That’s where PromptCloud comes in. With powerful web scraping infrastructure and customized data delivery, we help investors tap into high-quality, relevant, and scalable alternative data streams, built for the way you actually work.

The edge is out there. It just might not be where you’ve been looking.Tell us what you need, and we’ll build a custom data pipeline that delivers exactly that, clean, actionable, and at scale. Share your requirements with us- let’s talk!