Fraud is one of the most significant challenges facing the insurance industry today. Whether it’s staged accidents, exaggerated claims, or identity theft, fraudulent activities cost insurers billions annually, driving up costs for honest customers and eroding trust. To combat this growing threat, insurance companies are increasingly turning to AI fraud detection systems.

These advanced systems rely on robust, high-quality data to identify suspicious patterns and prevent fraudulent activities. By leveraging web data, insurers can train AI models that are more accurate, adaptable, and capable of real-time detection. Let’s explore how insurance companies can use web data to power AI fraud detection and revolutionize their fraud prevention strategies.

Rising Fraud Threats in the Insurance Industry

Fraudulent claims account for an estimated 10% of total insurance payouts globally, translating to billions of dollars in losses each year. With fraudsters becoming more sophisticated, traditional methods of detection – such as manual reviews or static rule-based systems—are no longer sufficient.

Key challenges include:

- Volume: Insurers process millions of claims annually, making it impossible to manually review each one.

- Complexity: Fraud schemes often involve multiple parties, staged evidence, and elaborate setups.

- Adaptability: Fraudsters continuously evolve their tactics to bypass detection mechanisms.

AI fraud detection systems address these challenges by analyzing vast amounts of data to identify patterns, anomalies, and red flags that human reviewers might miss.

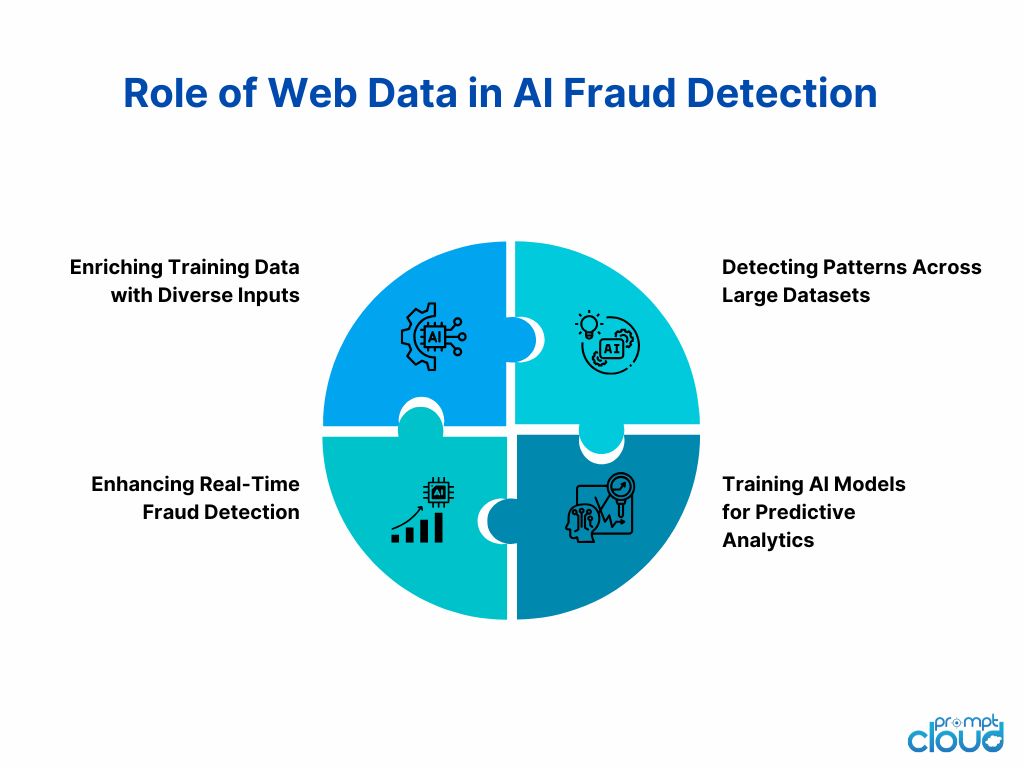

How Web Data Powers AI Fraud Detection?

While internal data – such as claims histories and customer profiles is vital, web data significantly enhances the capabilities of AI fraud detection models. Here’s how:

1. Enriching Training Data with Diverse Inputs

Web data provides access to a wide array of information, including:

- Social Media Activity: Identifying discrepancies between a claimant’s stated circumstances and their publicly shared posts.

- News Reports: Detecting incidents reported in the media that contradict claim details.

- Third-Party Databases: Cross-referencing customer information with public records to verify identities and activities.

By integrating this data, AI models gain a broader context, improving their ability to differentiate between genuine claims and fraudulent ones.

2. Detecting Patterns Across Large Datasets

Fraud often involves recurring patterns, such as multiple claims linked to the same individual, vehicle, or address. Web scraping enables insurers to collect data at scale, revealing:

- Connections between seemingly unrelated claims.

- Repeated use of fake identities or stolen credentials.

- Unusual spikes in claims related to specific events or locations.

For example, scraping data on reported accidents from news websites can help insurers cross-verify the legitimacy of claims tied to those events.

3. Enhancing Real-Time Fraud Detection

Fraud detection needs to be swift to prevent fraudulent payouts. Web scraping provides real-time data feeds, allowing AI models to:

- Monitor ongoing activities, such as sudden increases in claims after natural disasters.

- Verify claim details instantly against online sources.

- Detect coordinated fraud attempts across multiple insurers.

Real-time integration ensures that insurers can act quickly, mitigating losses and deterring fraudsters.

4. Training AI Models for Predictive Analytics

Predictive analytics plays a crucial role in AI fraud detection, enabling insurers to anticipate fraudulent behavior before it occurs. Web data enhances these capabilities by:

- Providing historical data on previous fraud cases for training.

- Feeding AI models with dynamic, real-world inputs to improve predictions.

- Identifying high-risk behaviors or profiles based on online activity.

For instance, training an AI model on data from fraudulent e-commerce transactions can help insurers detect similar patterns in their claims systems.

How AI Fraud Detection Leverages Web Data?

To build effective AI models, insurers need to integrate web data into their fraud detection workflows. Here’s a step-by-step breakdown:

1. Data Collection

- Web scraping tools extract relevant data from social media, news outlets, public records, and forums.

- Data is collected in real time or at scheduled intervals, ensuring freshness and relevance.

2. Data Processing

- Raw data is cleaned, structured, and prepared for analysis.

- Advanced tools remove noise and inconsistencies, ensuring only high-quality inputs feed the AI model.

3. Model Training

- AI algorithms analyze the processed data to learn patterns, relationships, and anomalies associated with fraud.

- The model is validated using test datasets to ensure accuracy and reliability.

4. Deployment and Monitoring

- The trained model is integrated into the claims process, flagging suspicious activities for further review.

- Continuous monitoring and retraining improve the model’s performance over time.

Why AI Fraud Detection is a Game-Changer for Insurers?

By leveraging web data, AI fraud detection offers several key benefits:

- Improved Accuracy: AI models analyze data holistically, reducing false positives and negatives.

- Cost Savings: Early detection prevents fraudulent payouts, saving insurers millions.

- Scalability: AI can process vast datasets effortlessly, making it ideal for large insurers.

- Customer Trust: Faster claim approvals for genuine policyholders enhance customer satisfaction.

Overcoming Challenges Insurers Face with AI Fraud Detection

While the benefits are significant, insurers must address challenges such as:

- Data Privacy: Ensuring compliance with regulations like GDPR when collecting and processing web data.

- Data Quality: Scraping tools must be capable of extracting clean, accurate, and relevant information.

- Ethical Considerations: Transparency in AI-driven decisions to maintain trust with customers.

Partnering with experienced web scraping providers like PromptCloud ensures these challenges are managed effectively.

PromptCloud’s Role in Enhancing AI Fraud Detection with Web Data

At PromptCloud, we specialize in delivering high-quality, customized web data solutions for AI fraud detection in the insurance industry. Our services include:

- Scalable Web Scraping: Extract data from diverse sources, including social media, news, and public records.

- Real-Time Data Feeds: Ensure your AI models operate with the most current information.

- Compliance Assurance: Adhere to ethical and legal standards for data collection.

- Data Customization: Tailor datasets to your specific fraud detection needs.

With PromptCloud, insurers gain the tools they need to stay ahead of fraudsters and protect their customers.

Conclusion:

As fraud continues to evolve, insurance companies must stay one step ahead by adopting advanced technologies like AI. Web data provides the breadth and depth of information needed to train robust fraud detection models, enabling insurers to identify and prevent fraud with unparalleled precision.

By integrating web scraping into their workflows, insurers can unlock the full potential of AI fraud detection, safeguarding their businesses while delivering better experiences for genuine customers.Ready to empower your fraud detection efforts with cutting-edge web data solutions? Contact Us Today and let PromptCloud help you build smarter, more effective AI models.