Hedge funds thrive on one core principle: gaining an edge over the market. Traditionally, this edge has been powered by access to financial reports, stock performance metrics, and macroeconomic indicators. But in 2025, relying solely on these conventional sources is no longer enough. The financial ecosystem is evolving rapidly, and with it, the strategies that separate winners from the rest. Enter alternative data—a transformative resource that’s reshaping how hedge funds operate and outperform.

If you’re wondering what makes alternative data so pivotal for hedge funds today, the answer lies in its ability to provide deeper, more nuanced insights into market behavior. Unlike traditional data, which often reflects past performance, alternative data for hedge funds offers real-time, actionable intelligence derived from unconventional sources such as social media, satellite imagery, web scraping, and transactional data.

Let’s explore why alternative data is no longer a “nice-to-have” but a “must-have” for hedge funds in 2025, how it’s being used effectively, and how to leverage it for maximum impact.

How Hedge Funds Are Evolving with Alternative Data?

The concept of alternative data for hedge funds isn’t entirely new. Over the past decade, hedge funds have increasingly turned to non-traditional data sources to supplement their decision-making processes. What’s different now, however, is the sheer volume, variety, and velocity of this data.

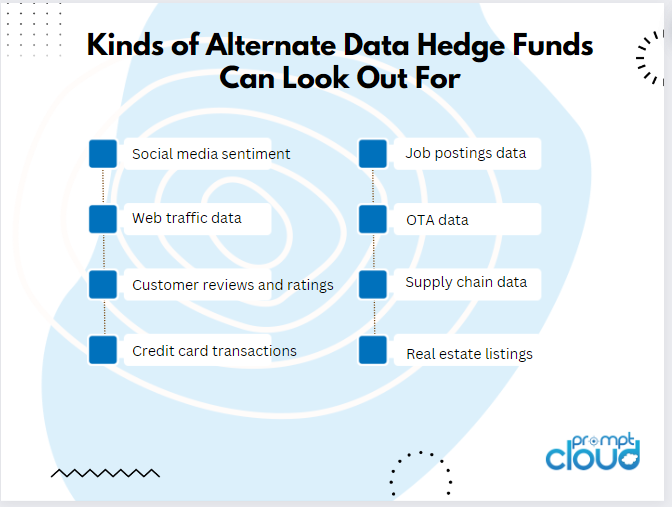

In 2025, alternative data comes from countless sources:

- Web scraping provides real-time insights into pricing trends, consumer sentiment, and inventory levels.

- Satellite imagery tracks supply chain disruptions or agricultural yield estimates.

- Transactional data reveals granular spending patterns across industries.

- Social media sentiment analysis helps hedge funds gauge public opinion on brands, products, or political developments that could influence markets.

Hedge funds now have the tools to process and analyze this flood of data with greater efficiency, uncovering patterns and insights that were previously invisible. This shift is giving firms a distinct advantage in identifying opportunities, mitigating risks, and staying ahead of market trends.

Why Alternative Data Is a Game-Changer for Hedge Funds?

1. Enhanced Market Predictions

Traditional data sources like earnings reports or government statistics often lag behind real-world developments. By the time this data is available, the market has already adjusted. Alternative data for hedge funds, however, provides near real-time insights, enabling quicker and more informed decisions.

For example, foot traffic data from retail locations can help hedge funds predict quarterly earnings before official reports are released. This level of foresight is invaluable in building a proactive investment strategy.

2. Diversification of Insights

Markets are increasingly influenced by non-financial factors, from geopolitical events to social movements. Traditional datasets are often ill-equipped to capture these variables, but alternative data fills the gap.

Consider how sentiment analysis on social media platforms can reveal public reactions to major news events, providing hedge funds with an early signal of potential market volatility.

3. Competitive Edge in High-Frequency Trading

Speed is critical in trading. With access to alternative data streams, hedge funds can identify patterns and execute trades faster than their competitors. Whether it’s detecting price anomalies through web scraping or using satellite imagery to assess inventory levels at manufacturing plants, the ability to act on these insights in real time is a game-changer.

4. Risk Mitigation

Markets are inherently unpredictable, but alternative data helps hedge funds manage uncertainty more effectively. Monitoring transactional data, for instance, can provide early warnings of economic slowdowns, enabling funds to hedge their positions or reallocate resources accordingly.

5. Deep Sectoral Insights

Different sectors react to market stimuli in unique ways. With alternative data for hedge funds, firms can gain sector-specific insights that guide their investment strategies. For example:

- In retail, web scraping can track inventory levels and sales trends.

- In agriculture, satellite imagery can forecast crop yields.

- In tech, transactional data can reveal adoption rates for new products or services.

How to Tackle Common Issues with Alternative Data Usage?

While the benefits of alternative data for hedge funds are immense, extracting value from it isn’t without challenges:

- Volume: The sheer quantity of data can be overwhelming.

- Variety: Diverse data formats make integration complex.

- Compliance: Ensuring data sourcing adheres to regulations is non-negotiable.

These challenges underline the importance of working with a reliable data partner. A service like PromptCloud can streamline the process, delivering clean, structured, and compliant data that’s ready for analysis.

Conclusion:

As hedge funds look to outperform in 2025 and beyond, the adoption of alternative data is no longer optional—it’s essential. The ability to access, process, and act on this data separates forward-thinking firms from those still relying on outdated methods.

PromptCloud stands out as a trusted partner in this space, providing the expertise, scalability, and compliance-first approach that hedge funds need to succeed.

If you’re ready to elevate your investment strategies with the power of alternative data for hedge funds, PromptCloud is here to help. Talk to Our Experts Today and discover how we can transform your data into actionable insights, empowering your hedge fund to stay ahead of the curve in 2025.