**TL;DR** The EV market doesn’t give second chances. One week, Tesla’s slashing prices across Europe like it’s clearing out stock for something big. Next, Tata Motors is quietly flooding emerging markets with budget EVs that actually make sense for middle-class buyers. Meanwhile, battery tech keeps leveling up, governments change their incentive rules mid-game, and charging networks pop up in places that had zero coverage a month ago. It’s not just hard to keep up; it’s nearly impossible if you’re relying on static reports, Google searches, or gut instinct.

If you’re tracking all this manually? You’ve already lost.

Most analysts are looking in the rearview mirror. Reports take weeks. Forums are full of noise. By the time you spot a competitor’s move, the market’s moved on.

Web scraping flips that. It pulls real-time data straight from the public web, product launches, customer reviews, price changes, stock levels, charging locations, and turns it into immediate, usable intelligence. It’s what the smart players use to see what’s happening, not just in headlines, but in backend listings, spec sheets, and review metadata.

This isn’t about being “tech-savvy.” It’s about survival in a market that punishes slow insight.

Still relying on spreadsheets? You’re competing with one eye closed. Working with a web scraping service provider? Now you’re playing offense.

The EV Boom: From Tesla to Tata, the Race Is On

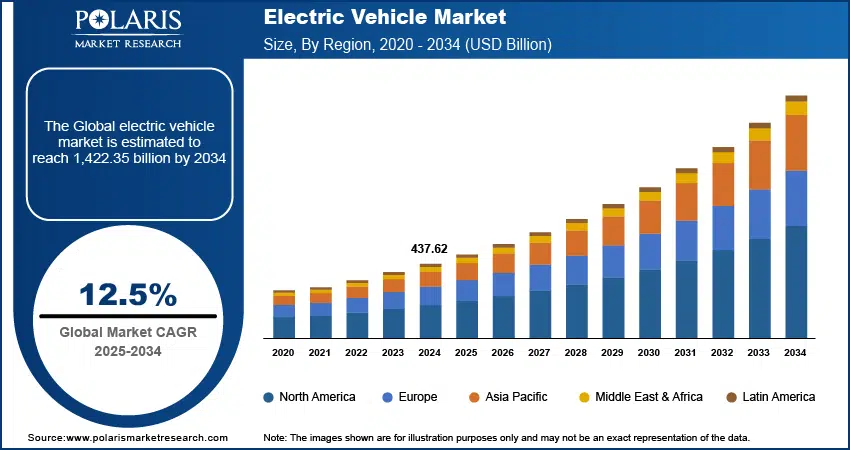

Image Source: polarismarketresearch

Ten years ago, the electric vehicle market was basically a one-man show. Tesla had the spotlight, and the rest of the automotive world watched from the sidelines, skeptical and slow to move.

Today? It’s a street fight.

Tesla’s still in the ring, launching Cybertrucks, tweaking Gigafactories, and slashing prices across continents like it’s playing 4D chess. But now, they’re not alone. Chinese giants like BYD are outselling them in key markets. Ford and Hyundai are dropping EV models faster than you can name them. And regional players like Tata Motors? They’re rewriting the EV rulebook in developing economies, offering smart, compact electrics that people want and can afford.

In India, Tata has captured over 70% of the EV passenger vehicle market as of early 2024. Seventy percent. That’s not just dominance, that’s disruption. And it’s happening while most analysts are still stuck comparing last quarter’s earnings reports.

Meanwhile, China registered over 8 million new EVs in 2023, and Europe is reshuffling its incentives by the month. Battery tech isn’t crawling anymore, it’s sprinting. Solid-state prototypes aren’t just whiteboard ideas; they’re showing up in pilot programs. Tesla’s so-called “Model 2”? The affordable EV that’s been teased for years? It keeps leaking in just enough detail to feel real and close. And while everyone’s still analyzing that, a new regulation rolls out, or a five-minute product review goes viral and flips public sentiment overnight. Miss a week, and you’ve missed the market.

Here’s the uncomfortable truth: no one has a complete picture of the EV market by just relying on press releases, financial reports, or analyst PDFs. By the time you read it, it’s stale.

What you really need is visibility, not from a bird’s-eye view, but from inside the data stream.

What are buyers saying about the Nexon EV Max this week? Which dealership just ran out of Hyundai Ioniq 5s? How many new charging stations went live in Maharashtra last month? These aren’t high-level “industry insights.” These are frontline signals. And they’re all out there, hidden in product listings, scraped review text, pricing pages, dealer sites, and infrastructure maps.

But you won’t find them in a McKinsey deck. You’ll find them on the open web if you know how and where to look.

That’s the real EV arms race. Not just building the best car, but knowing what’s happening in the market before your competitors do.

Why the EV Market Is So Hard to Track Manually

Let’s call it what it is: trying to track the EV market with traditional tools is a losing game. The landscape shifts daily. One update here, a new subsidy there, a surprise launch no one saw coming. If you’re relying on static dashboards, analyst PDFs, or once-a-month research meetings, you’re not just behind, you’re out of touch. This market doesn’t wait.

The biggest myth in the room? That you can understand EVs by reading quarterly reports and scanning a few press releases. That might’ve worked when there were five serious players. Now there are fifty. And they’re all moving at startup speed.

Here’s what makes this market so slippery:

1. Innovation Has No Patience

New battery chemistry. Over-the-air software updates. Autonomous driving rollouts. Subscription-based ownership models. This isn’t your grandpa’s automotive market; it’s tech on wheels. Tesla can drop a software update that changes performance metrics overnight. BYD might announce a new hybrid architecture while you’re still digesting their last launch. And that three-month-old product comparison you bookmarked? It’s ancient history.

2. Data Is Scattered Across the Internet

Want to know which EV models are being discounted this week? You’ll have to check dozens of dealership sites, each with its own layout. Curious about how the Tata Punch EV is faring in consumer sentiment? Get ready to sift through YouTube reviews, Twitter threads, Reddit discussions, and three local language forums. The information is out there, it’s just buried under layers of fragmentation.

3. Local Policy Changes Happen Overnight

EV subsidies aren’t set in stone. In fact, they’re political bargaining chips. States tweak them. Countries cancel them. New ones roll out with confusing clauses and eligibility terms. These policy updates may not even reach mainstream media before they impact buyer behavior. Miss one change, and you’ll be scratching your head, wondering why bookings dropped 20% in a region overnight.

4. The Infrastructure Gap Is a Moving Target

Charging stations are going live every day, but not everywhere. A city might add 50 public fast-charging points this month, and zero the next. These deployments shape how and where people buy EVs. But good luck finding a central dashboard that tells you how infrastructure is influencing local adoption. That data lives on government portals, real estate forums, and charging app APIs.

In short, the EV market isn’t hard to track because it’s hidden. It’s hard to track because it’s happening online, all the time, in a hundred different places at once.

And unless you have a way to pull all those threads together, you’re not getting the real story. You’re getting the sanitized, delayed version that shows up in earnings calls after the real decisions have already been made.

That’s why analysts, investors, and even automakers themselves are turning to a different solution, one built for real-time intelligence at internet scale.

And yes, we’re talking about web scraping.

Enter Web Scraping: The Secret Weapon for EV Market Intelligence

Here’s the part most people get wrong about web scraping: it’s not about collecting random bits of data from the internet. It’s about seeing what your competitors don’t want you to see until it’s too late and doing it faster, cleaner, and more consistently than any intern with a spreadsheet ever could.

Think of web scraping as your surveillance system for the EV market. Not in the creepy, spy-movie sense. In the “we know exactly when, where, and how the next market shift is happening” sense.

So What Is Web Scraping, Really?

Simple version? It’s a way to automatically extract structured data from public websites, at scale. Thousands of data points, pulled daily, hourly, even by the minute, from the places your audience is actually paying attention to.

We’re talking:

- Product listings on automaker websites and EV marketplaces.

- Reviews on Amazon, Flipkart, Autocar, and everything in between.

- Dealer inventories and pricing updates in real time.

- Charging infrastructure directories.

- Regulatory updates from government portals.

- Forum chatter. Twitter rants. YouTube comments.

You name it. If it’s publicly available, it can be scraped.

And no, we’re not talking about some off-the-shelf plug-in scraping five pages and calling it a day. We’re talking enterprise-grade extraction, robust, customizable, and built to keep up with the breakneck pace of the EV ecosystem.

Why Is This a Big Deal for the EV Market?

Because everything that matters is happening online first. Long before you read about Tata’s new EV in a Business Standard piece, it’s quietly listed on their site, with pricing, spec sheets, and target markets laid out. Before a new charging station gets a press release, it’s sitting live on a map API. Before the sentiment around Tesla’s Full Self-Driving beta goes mainstream, it’s boiling in Reddit threads and YouTube comments.

You could try keeping up manually. Refresh a few sites, maybe set some Google Alerts. But let’s be honest, that’s bringing a bicycle to a drag race.

The EV game is being played in real time. Every update, every launch, every price drop, it’s data. And if you’re not capturing it as it happens, someone else is. Probably your competitor. Probably with help from a web scraping service provider who’s already feeding them daily dashboards while you’re still waiting for the next EV market report.

So yeah, web scraping is technical. But the value does it bring? That’s crystal clear.

It’s not just about data. It’s about decoding the EV market while the engine’s still warm.

Your data collection shouldn’t stop at the browser. If your scrapers are hitting limits or you’re tired of rebuilding after every site change, PromptCloud can automate and scale it for you.

Let us show you what first-mover advantage looks like.

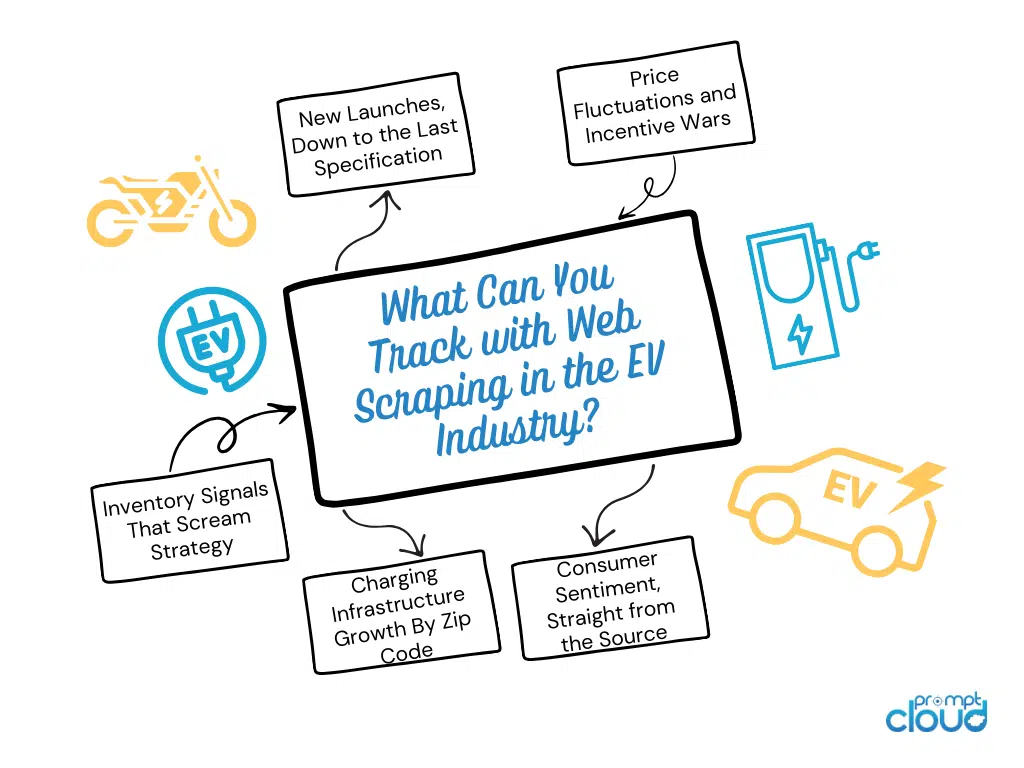

What Can You Track with Web Scraping in the EV Industry?

Let’s cut through the fluff. The EV industry isn’t just about car sales; it’s about a complex, constantly shifting web of moving parts: tech specs, consumer reviews, supply chains, government incentives, and infrastructure. And all of that leaves a trail online.

Web scraping lets you tap into that trail. It doesn’t guess. It watches. And here’s what it sees, in real time.

1. New Launches, Down to the Last Specification

EV makers aren’t subtle. When they’re about to drop a new model, the signs are everywhere: early product pages, teaser images, updated spec sheets. Web scraping picks that up immediately.

Want to know when Tata updates the Nexon EV with a new battery pack? Scrapers catch that the second the page changes. Need to monitor when Tesla adjusts the range estimate for the Model Y on its UK site? Done. Before the news hits TechCrunch, your dashboard already lit up.

2. Price Fluctuations and Incentive Wars

EV prices are like airline tickets; they don’t stay put. Automakers run flash discounts. Dealers shave off margins to meet quarterly targets. Local governments throw in limited-time subsidies or tax breaks.

You can’t track all of that manually. But web scraping can.

You’ll know when Tata cuts ₹20,000 off the Tigor EV in Gujarat, or when Tesla silently rolls out a $1,000 discount in California. More importantly, you’ll see it before your customers do — which means you get to adjust your pricing, messaging, or inventory strategy before your sales tank.

3. Inventory Signals That Scream Strategy

When a model disappears from a dealership site, it means something. Maybe it’s selling like crazy. Maybe it’s being phased out. Maybe they’re about to relaunch it with upgrades.

Scraping inventory pages tells you which EV models are gaining traction, which ones are lagging, and where. If Mahindra’s new XUV400 goes out of stock across five southern states, that’s not a coincidence. That’s a buying trend. One you want to catch, not read about after your competitor capitalizes on it.

4. Charging Infrastructure Growth By Zip Code

Everyone talks about “range anxiety,” but what really drives EV adoption is where you can charge.

Scraping charging station maps, EV route planner APIs, or even utility company updates can show you where infrastructure is expanding. That kind of intel helps you predict where EV sales are going to spike next.

If a new cluster of DC fast chargers just popped up outside Pune, it’s not a local story; it’s a buying trigger. And you want your marketing, inventory, and distribution plans locked in before anyone else connects those dots.

5. Consumer Sentiment, Straight from the Source

Forget survey panels. The truth lives in the comment section.

Scraping Amazon reviews, YouTube comments, Reddit threads, and auto forums gives you a pulse on what real buyers think. Not just star ratings, actual complaints, real praise, and emotional reactions. That’s where you see whether buyers think the MG Comet EV is a smart city car or a plastic toy with wheels.

You’ll spot problems before they become PR disasters. You’ll catch trends before your competitors jump on them. And you’ll do it all by listening at scale.

So, let’s be clear: web scraping doesn’t just feed you data. It feeds you the right data across all touchpoints of the EV ecosystem.

Specs, pricing, inventory, infrastructure, sentiment, scraped, sorted, delivered. Daily.

That’s not research. That’s foresight.

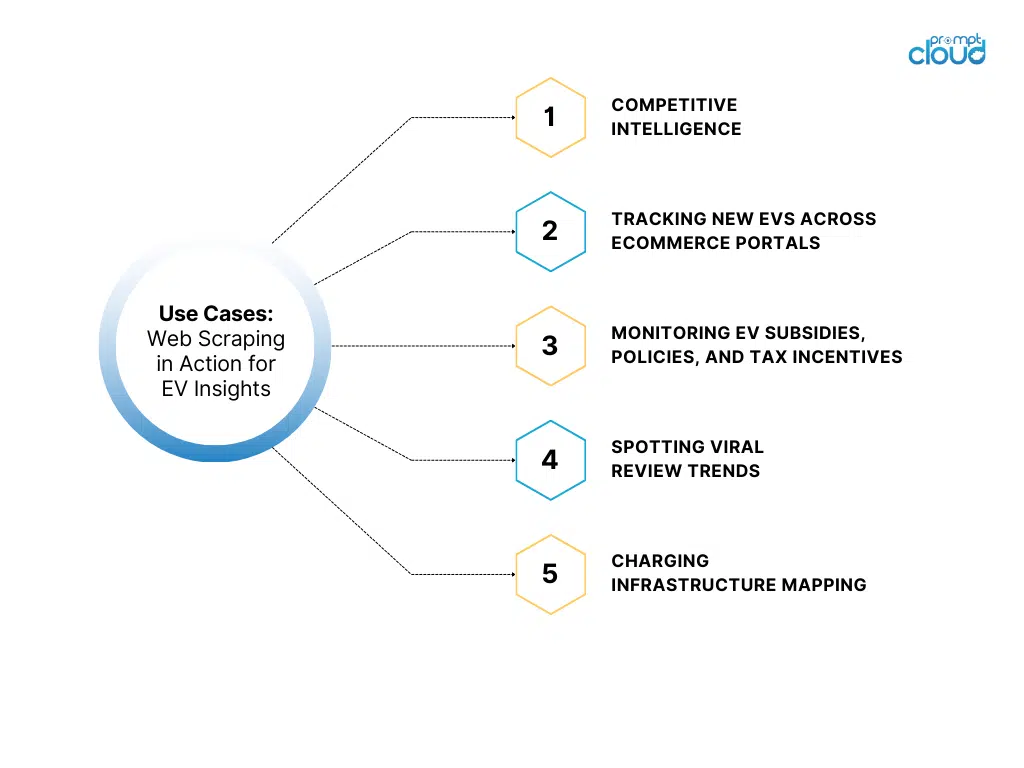

Use Cases: Web Scraping in Action for EV Insights

It’s one thing to say web scraping is powerful. It’s another to see what it can actually do when deployed in the wild. So let’s get out of theory mode and talk about real, boots-on-the-ground use cases, where scraping doesn’t just collect data; it turns the lights on in rooms most people didn’t know existed.

1. Competitive Intelligence

Imagine having a dashboard that updates daily with every pricing tweak, product variant, and availability shift across your top five EV rivals. That’s not a luxury, that’s table stakes now.

Let’s say Tata just launched a new variant of the Punch EV with an extended range and a ₹10,000 discount for the first 500 buyers. It’s only live on their official site and buried inside a dealership network landing page. Unless you’re scraping those pages, you’re not going to catch it. But your competitor will.

The same goes for Tesla. They’re famous for silent price drops and spec nudges. Web scraping catches it all, the minute it happens. One line of code sees what most research teams miss.

Now imagine doing this not just for one region, but across every market you operate in. What you get is an always-on radar system for competitive EV data. You don’t react two weeks late; you move with the market.

2. Tracking New EVs Across Ecommerce Portals

Yes, EVs are now selling online. And no, they’re not just selling through official channels.

Third-party ecommerce platforms, listing aggregators, and classified portals, these sites often reveal new launches, dealer discounts, and early customer sentiment long before the OEM’s PR team gets involved.

Scraping these platforms gives you something no press release ever will: real-world availability. Are customers booking the MG ZS EV on Amazon India? Is there a waitlist forming for Hyundai’s next-gen Kona on Flipkart? You’ll never know, unless your system is watching.

And once the listings go live, scraping lets you track how the listing evolves. Did the price change? Did the wait time increase? Did the language around the battery warranty shift? Every edit tells a story.

3. Monitoring EV Subsidies, Policies, and Tax Incentives

Governments love tinkering with EV incentives. One day, there’s a ₹1.5 lakh rebate on a car; the next, it’s phased out. And most of the time, these changes live on obscure government portals that no one checks unless they have to.

Web scraping fixes that.

By scraping state and central EV policy pages, news updates, and government circulars, you can set up live alerts every time a subsidy changes. Whether it’s Germany tweaking its Umweltbonus or Delhi adding a new commercial EV incentive, you’ll know right away.

Now you’re not just tracking vehicles. You’re tracking the rules of the game.

4. Spotting Viral Review Trends

You know what kills a product? Not the first bad review, but the fifth, when people start quoting it in YouTube videos.

Scraping reviews gives you more than just star ratings. It gives you early warnings. Maybe people are calling out a design flaw in the Citroën ë-C3 that hasn’t hit mainstream media yet. Maybe a new Ola Electric scooter has charging issues in colder regions, and the Reddit threads are heating up.

You won’t find that insight in your monthly VOC report. But scraping Reddit, Twitter, YouTube, and review platforms will put it on your radar before it becomes a PR crisis.

5. Charging Infrastructure Mapping

EV adoption doesn’t happen in a vacuum. It follows the charger. Scraping APIs from charging apps or updates from energy providers tells you where the infrastructure is going.

If a new corridor of chargers goes live along the Bangalore–Mysore highway, that data tells you something. It says: Get your sales and service strategy ready for EV adoption in this zone.

And guess what? Your competitors are watching the same thing. The question is: who sees it first?

Bottom line? This isn’t guesswork. This is full-spectrum intelligence on the EV market, captured automatically, continuously, and precisely.

Web scraping turns your team from blindfolded guessers into informed operators. It connects dots that others don’t even see. It gives you leverage.

And in a space as fast-moving as EVs, leverage is the only edge that matters.

Why Web Scraping Beats Traditional Research Methods for EV Analysis

Let’s not sugarcoat this: traditional EV market research is broken. Not because the people doing it aren’t smart, but because the tools they’re using belong in a different decade.

Waiting for analyst reports, reading whitepapers, or paying a firm to run a consumer survey twice a year? That might’ve worked when the market moved like molasses. But this is EV. It moves like lightning.

If your insight is a month old, it’s irrelevant. If it’s a week old, it’s shaky. If it’s not today, you’re behind.

Here’s why web scraping leaves legacy research in the dust:

1. Speed That Matches the Market

Traditional methods crawl. Web scraping moves in real time.

You’re not waiting for data to be compiled, cleaned, and published. You’re not hoping a research firm noticed that Tata just rolled out an OTA software update. With scraping, that data hit your dashboard hours ago. No delay. No filter. Just live intelligence.

2. Granularity That Analysts Don’t Touch

Ever seen a market report that tells you which colors of the Hyundai Ioniq 5 are most backordered in southern India? Or how many reviews mention “charging issues” for a specific battery variant on Amazon?

You won’t. But scraping can get you that. Because it doesn’t just pull headlines, it pulls the hidden metadata most reports ignore.

It tracks variant-level pricing. It catches spec sheet edits. It sees which dealerships are selling out of which trims and which ones are quietly jacking up prices due to demand. That’s ground-floor insight you can actually act on.

3. It Doesn’t Wait for the News

Press releases are PR theater. The real story is in the code behind the product page.

When Tesla updates its Model Y specs at midnight, web scraping doesn’t wait for Elon’s tweet or a Reuters article. It catches the page change in real time.

Same with infrastructure data. You’ll know the second a new charging hub goes live on the map, before the ribbon-cutting ceremony even happens.

By the time it’s news, it’s old news.

4. It’s Not Just Faster, It’s Smarter

Web scraping doesn’t just get data faster. It gets the right data.

Let’s say your team is trying to understand why EV adoption in Kerala is accelerating faster than in Tamil Nadu. Traditional reports might hand you vague hypotheses. Scraping will show you:

- A spike in newly listed fast-charging stations

- A regional policy change was published quietly on a government portal

- A surge in Nexon EV stockouts in local dealerships

- An uptick in five-star reviews mentioning range confidence

That’s the kind of insight that changes strategy, not just decks.

5. It Scales Where Humans Break

Sure, a person can check five websites a day. Maybe even ten. But what about 500? What about all Tata dealers across India? Every Tesla listing in Europe? Every Chinese EV startup’s landing page?

Scraping doesn’t get tired. It doesn’t skip weekends. It doesn’t overlook the details.

You set the rules. It watches everything.

Bottom line? Traditional EV research tells you what happened. Web scraping shows you what’s happening.

If you’re trying to win in a market where every launch, policy, and customer review can shift demand overnight, you need to operate in real time. That means ditching static dashboards and going straight to the source, the web itself.

And unless you’ve got a 50-person team scraping pages by hand, you’ll need to call in the experts.

Which brings us to the people who make this whole system run: the web scraping service providers.

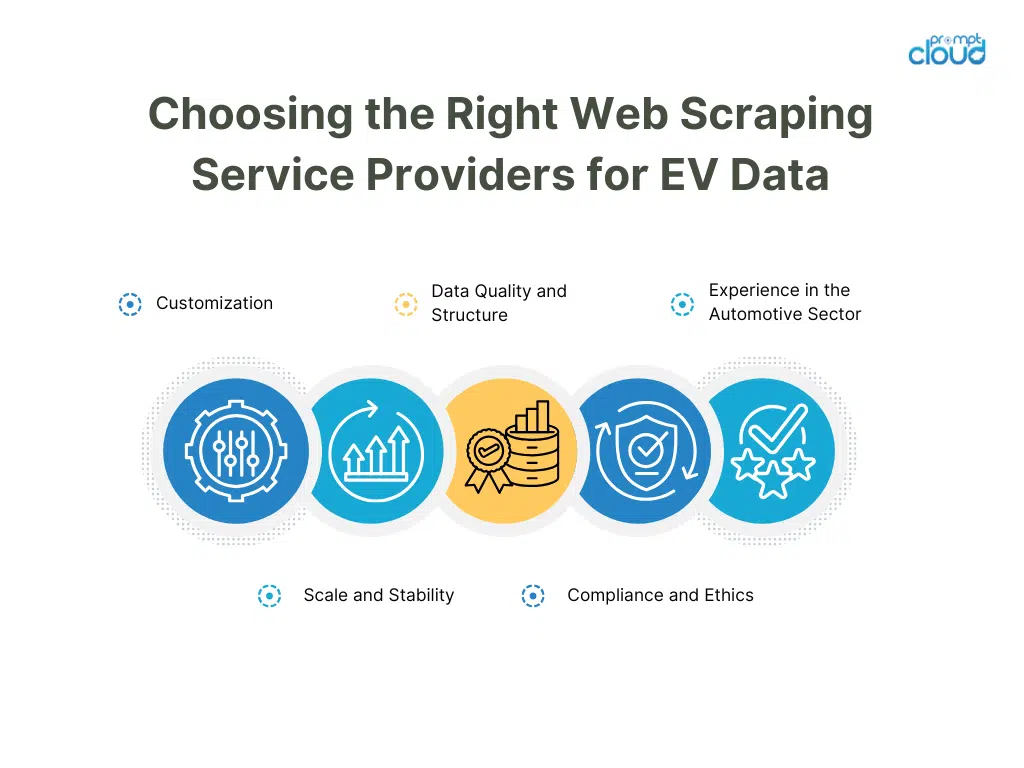

Choosing the Right Web Scraping Service Providers for EV Data

This is the part where most teams trip up. They understand why they need web scraping. They even know what they want to track. But when it comes to choosing who to trust with the job, they either overthink it or get seduced by the wrong promises.

Here’s the truth: not all web scraping service providers are built for the EV world.

This industry isn’t simple. You’re not scraping one price from one page. You’re tracking real-time market signals across hundreds of sources, spec sheets, review platforms, infrastructure maps, regional policy updates, ecommerce listings, and more. It’s messy. It’s fragmented. It’s multilingual. It changes constantly.

If your scraping partner can’t handle that complexity? You’re not just missing data, you’re making the wrong decisions.

So what should you actually look for?

1. Customization: Because EV Data Isn’t One-Size-Fits-All

Generic scraping tools won’t cut it. You need a provider that builds tailored pipelines based on your use case.

Want to track real-time charging station availability in Karnataka? Done. Need sentiment data from regional-language YouTube reviews? It’s possible. Trying to monitor dealer-level stock shifts across Southeast Asia? That’s not even niche anymore; it’s necessary.

Your provider should get this. If they offer a one-click dashboard and walk away, run.

2. Scale and Stability: Because This Isn’t a Side Project

The EV market doesn’t sleep. Your scraping infrastructure shouldn’t either.

When Tesla changes product copy at midnight or Tata pushes a last-minute discount to five regional dealer sites, your provider needs to catch it without blinking. That means:

- Rotating IPs to avoid bans

- Infrastructure that can scale to scrape millions of pages weekly

- Monitoring systems that recover from page layout changes automatically

This isn’t a “nice to have.” It’s the bare minimum.

3. Data Quality and Structure: Because Raw Isn’t Useful

Pulling data is easy. Making it clean, labeled, structured, and ready for analysis? That’s where the real work happens.

If you’re scraping customer reviews, are they tagged by feature? Are regional language reviews translated and sentiment-flagged? Is pricing data normalized across sources?

You don’t want 10,000 messy rows. You want intelligence you can plug into your systems and actually use. Every day. At scale.

4. Compliance and Ethics: Because the Stakes Are Higher in Automotive

The EV space is global, public-facing, and highly scrutinized. You don’t want shortcuts.

Any provider worth your time should be transparent about their legal and ethical scraping practices. That means:

- Respecting site terms and robots.txt

- Scraping only publicly available data

- Avoiding anything that puts your brand at legal risk

Look for a partner who treats compliance as part of the product, not as an afterthought.

5. Experience in the Automotive Sector: Because Context Matters

EV data isn’t like scraping fashion or finance. It has nuance. A provider who knows what a WLTP range is, or why battery pack variants matter, will always deliver more valuable output than one who doesn’t.

Look for case studies. Ask who they’ve worked with in automotive or mobility. If they don’t have an answer, they’re probably learning on your dime.

At PromptCloud, we’ve been in the web scraping space for over a decade. We’re not new to this, and we’re certainly not guessing.

Our custom web scraping services are already powering EV market research, competitor tracking, and infrastructure mapping for some of the most data-hungry clients on the planet. Quietly, reliably, every single day.

But this article isn’t a pitch. It’s a wake-up call.

Because while most teams are still treating web scraping like a nice extra, the smart ones are treating it like survival tech.

Staying Ahead in the EV Game Requires Smarter Data

Let’s not kid ourselves, the EV industry isn’t waiting for anyone.

The market is expanding, evolving, and constantly reacting. What worked six months ago is irrelevant today. Pricing isn’t static. Customer sentiment isn’t predictable. Competitors aren’t courteous enough to warn you before they eat your market share.

And that’s exactly why real-time, structured, large-scale data isn’t just helpful, it’s mission-critical.

This isn’t about “being data-driven.” Everyone says that. This is about seeing the signals that others miss:

- Catching a new model quietly added to a dealer’s inventory before the ad campaigns start

- Spotting policy changes before they ripple through purchase behavior

- Watching infrastructure rollouts in real time so you can forecast regional demand

- Monitoring product review sentiment so you’re not blindsided by public perception

- Seeing a competitor’s price drop the second it goes live

That kind of visibility? That’s not coming from Excel sheets or static reports. It’s coming from the open web, scraped, cleaned, structured, and delivered by professionals who know how to operate at scale.

The brands that win in EV aren’t guessing. They’re scraping.

They’re not reacting to headlines. They’re the ones making moves that become headlines. And the only way they do that is by seeing the full board, while everyone else is still playing with missing pieces.

So ask yourself: are you still trying to piece together market insight with manual research, outdated dashboards, and second-hand news?

Or are you ready to see the EV market as it actually is, live, fast, and full of opportunities?

If it’s the latter, start with data. Start with web scraping.

And if you want to get there without the tech debt and headaches?

Work with people who do this for a living.

Still Watching the EV Market from the Sidelines? Time to Step In.

If you’ve made it this far, you already get it: the EV market is wild, fast, and brutal to anyone not paying attention in real time.

Web scraping isn’t some futuristic buzzword. It’s the difference between being early and being obsolete, between seeing what’s next and reacting when it’s already too late.

So whether you’re a researcher trying to forecast demand, a competitor analyst tracking Tata’s every move, or a startup trying to make sense of Tesla’s market play, stop guessing. Stop waiting. Start seeing the whole picture.

And if you’re ready to do that at scale, quietly and reliably, every day?

We should talk. Contact us today at sales@promptcloud.com

Your data collection shouldn’t stop at the browser. If your scrapers are hitting limits or you’re tired of rebuilding after every site change, PromptCloud can automate and scale it for you.

Let us show you what first-mover advantage looks like.

FAQs

1. What is web scraping in the EV industry?

It’s your eyes on everything that matters. Web scraping in the EV world means pulling live, public data from sites that actually move the market, OEM product pages, dealership listings, policy portals, charging station maps, customer reviews, and more. Think of it as a real-time feed of what’s changing, where, and how fast delivered before anyone else spots it.

2. Why is it important to track the EV market in real time?

Because EV doesn’t follow quarterly timelines, it turns on a dime. If you’re still operating on monthly updates or static dashboards, you’re flying blind. Real-time tracking means you catch the price drops, model launches, policy tweaks, and infrastructure expansions the moment they happen, not after your competitors already acted on them.

3. Can web scraping help with competitor analysis in EVs?

Not only can it help, it’s the only way to stay ahead. Scraping gives you a front-row seat to every move your competitors make. You’ll know when they launch a new trim, change pricing, run a regional promo, or quietly sell out of inventory in a specific state. It’s like having market radar, tuned to the exact players you care about.

4. Is web scraping legal for EV market research?

Yes, when it’s done responsibly. Reputable web scraping service providers stick to public data, follow platform rules, and stay on the right side of compliance. The goal isn’t to break into systems; it’s to collect what’s already out there, faster and smarter than your competitors.

5. How do I choose a web scraping service provider for EV data?

Don’t fall for one-size-fits-all tools. Choose a provider that understands how messy, complex, and fast-moving EV data really is. You want a partner who builds custom pipelines, handles scale, delivers clean structured data, and actually knows how this market works. Anything less, and you’re leaving insight and margin on the table.