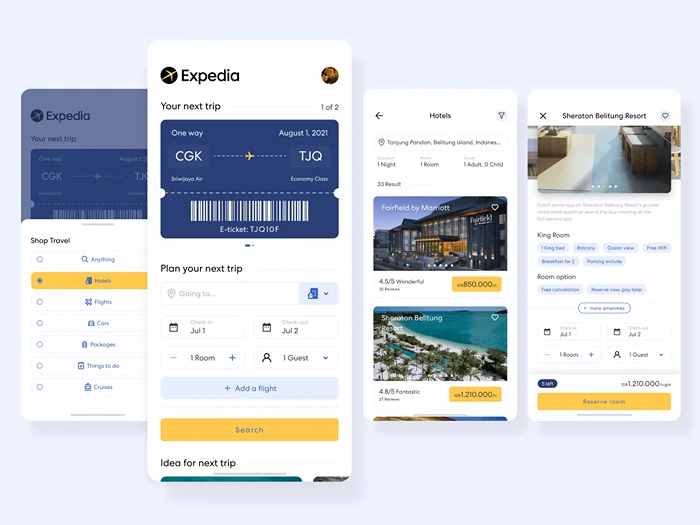

**TL;DR** Expedia isn’t just about prices. If you look closely at hotel listings, you can start to see patterns in the rooms they promote first, the extras they mention, how often certain offers appear, and when availability shifts. Those little changes can tell you a lot about how another hotel is thinking about its prices. Keep watching over weeks or months, and the story becomes clearer. And yes, you can collect all that without chasing the actual numbers, especially if you’ve got a web scraping solution that can pull the details for you.

Expedia Listings Hold More Clues Than You Think

Image Source: Kaggle

When most people think about competitor research in the hotel world, they picture tracking prices. It makes sense — price is often the deciding factor for travelers choosing between two similar properties. But here’s the thing: on platforms like Expedia, the real story isn’t only in the numbers. It’s hiding in plain sight inside the listings themselves.

Hotels work hard to stand out on Expedia. Look closely at their listing and you’ll see that every little choice is intentional, right down to the wording of the room names and the order of the bullet points. Those decisions, while they might seem small, tell you almost everything about their market strategy and the specific type of guest they want to welcome through the door.

They won’t hand you next season’s rates on a silver platter, but you can still pick up hints. Maybe a new premium suite pops up in the lineup. Maybe a free breakfast suddenly makes it into the headline. Or perhaps “limited-time” deals start appearing more often. These changes aren’t random — they’re part of a broader strategy that can point toward where their prices might be heading. These are signals of how they’re shaping their rates, even if you never see the actual numbers.

This kind of insight matters because pricing isn’t just about the present — it’s about anticipating the next move. And when you can do that, you’re not just reacting to the market, you’re staying one step ahead. With the right approach (and the right web scraping solutions to gather the data at scale), Expedia’s listings can become your own quiet source of competitive intelligence.

Reading Between the Lines of Expedia Hotel Listings

Expedia isn’t just a booking site; it’s one of the most powerful stages for hotels to showcase themselves. Every listing is a carefully built storefront, designed to grab attention and win bookings. For anyone studying the competition, these listings are full of hints — if you know where to look.

Below are some of the most telling elements inside Expedia listings that can quietly reveal what a competitor might be thinking when it comes to pricing and positioning.

Room Types and Categories Tell a Story

The order and variety of rooms in a listing can show how a hotel is positioning itself in the market. A sudden addition of premium suites or the removal of budget rooms can signal a shift in target audience — and likely in pricing.

Amenities Highlight Market Focus

Hotels don’t list amenities at random. If a property starts pushing luxury perks like spa access or private transfers, it may be moving toward higher rates. If the focus shifts to free breakfast and Wi-Fi, they might be chasing value-driven travelers.

Promotions and Offers Reveal Timing

Limited-time offers, flash sales, and bundled packages can tell you when a competitor is trying to boost occupancy. These timing patterns often repeat seasonally, offering a window into their pricing calendar.

Availability Changes Show Demand Pressure

Watching how availability shifts week to week can hint at occupancy levels. If rooms disappear quickly for certain dates, it could mean high demand, which often precedes a price increase.

Decoding Competitor Pricing Strategy from Listings

Spotting the clues in Expedia listings is one thing; turning them into a clear picture of your competitor’s pricing strategy is another. The good thing is, you don’t have to just guess. Once you start linking what you see to the types of rooms, the perks they’re showing off, the offers they run, and even when rooms are available, you’ll begin to notice patterns taking shape.

Room Upgrades Point to Market Positioning

If you spot a hotel adding more high-end rooms to its lineup, it’s usually a sign they’re going after guests who are willing to spend more. Chances are, that also means prices will creep up, especially when demand is at its highest. On the other hand, removing top-tier rooms or pushing budget options can be a sign they’re preparing for price-sensitive demand.

In both cases, you’re not just seeing the rooms — you’re seeing the shift in the kind of customer they want, which directly ties to their pricing playbook.

Promotions Reflect Demand Cycles

Sales and discounts can give away a competitor’s trouble spots. Say a hotel runs big promotions every January — that’s probably their way of filling rooms after the holiday rush. If you catch on to that pattern early, you can decide whether to match them with your own deal or take a different approach before they even launch it.

Tracking over time helps you separate one-off experiments from recurring patterns — and it’s the recurring ones that give you the best window into their pricing rhythm.

Availability Patterns Reveal Pressure Points

A listing that’s “sold out” months in advance for certain weekends? That’s a high-demand period where prices are likely to be at their peak. Availability that stays open right up to the date? That’s a sign of soft demand, which often pushes prices down or sparks last-minute deals.

If you keep track of this for months — or better yet, a few years — you’ll start to see a clear picture of when a competitor can charge top dollar and when they’re scrambling to fill rooms.

Putting It All Together

The real value comes from looking at these signals. When you see a new premium room show up alongside fancier perks and fewer discounts, it’s a pretty safe bet that the hotel feels comfortable charging more. But if they’re leaning on budget-friendly extras, running lots of deals, and keeping plenty of rooms open, that’s usually a sign they’re aiming for price-conscious guests.

By reading listings this way, you’re essentially translating their public marketing into a behind-the-scenes view of their pricing strategy, without ever touching the actual prices.

The Power of Tracking Trends Over Time

Looking at an Expedia listing once is like checking the weather through a keyhole. You’ll catch a moment, not the pattern. Pricing strategy — and the signals that surround it — only make sense when you watch them evolve. That’s why steady observation beats one-off snapshots. When you track listings week after week, the noise fades and the real story about hotel rates and positioning starts to show.

Why one-off checks miss the bigger picture

A single listing view might show a flash sale or a new room type, but you can’t tell if it’s a test or the start of a shift. When you monitor changes across several weeks, you see whether that “limited-time” offer reappears, whether the premium suite stays near the top of the page, and whether amenity highlights settle into a new pattern. That continuity turns guesswork into evidence.

Build a simple baseline, then watch for deviations

Create a baseline for each competitor on Expedia: typical room lineup, usual amenity emphasis, common offer language, and normal lead-time availability. Once that baseline is in place, deviations jump out. If a value-focused property suddenly starts pushing spa access and private transfers, it’s a clue they’re testing a higher-rate positioning. If availability stays wide open for dates that usually sell out, expect more aggressive promotions soon.

Seasonality matters more than you think

Hotels live by the calendar. Events, school breaks, festivals, and conferences all affect demand. By comparing the same weeks year over year, you can separate genuine strategy changes from seasonal rhythms. If a competitor runs a “stay 3, pay 2” every late August on Expedia, that’s not a surprise; it’s a pattern. The surprise is when they skip it — or launch it earlier, which can hint at a new pricing play.

Cadence: How often should you track?

Weekly tracking is a practical sweet spot for most teams. It’s frequent enough to catch promotional cycles and availability swings, but light enough to manage without burning hours. For high-stakes windows — big holidays, citywide events, or long weekends — a twice-weekly check helps you see micro-moves, like a new package going live midweek or a room reordering just before the weekend. This is classic hotel price monitoring without touching the price itself.

Turn small signals into early warnings

Tiny listing changes can be early warnings of bigger moves on hotel rates. A new “breakfast included” badge creeping into the headline, the sudden push of connecting rooms for families, or a string of free-parking mentions can precede a broader value strategy. On the premium side, a stronger spotlight on suites, club access, and late checkout perks can foreshadow firmer rate resistance during peaks. Track these quietly, and you’ll know which way the wind is blowing before the market does.

Do it at scale with web scraping solutions

Manually revisiting dozens of Expedia listings gets old fast — and it’s easy to miss changes. With the right web scraping solutions, you can collect the same structured listing fields consistently: room names, amenity text, promo copy, and visible availability signals. Once the data is standardized, you can compare competitors side by side and watch the trend lines instead of eyeballing screens. It’s cleaner, faster, and, most importantly, provides insights that help newcomers to data make confident calls.

Using Hotel Price Monitoring Without Direct Price Scraping

When most people hear “hotel price monitoring,” they think of pulling live rates from booking sites. But here’s the twist — you can still get a surprisingly clear view of competitor strategies without touching those numbers at all. Expedia listings are packed with indirect pricing signals that, when pieced together, tell a full story.

Image Source: scrapingbee

Why skip direct price scraping?

There are a few reasons. First, it’s about compliance and reducing risk — not every hotel or travel site allows direct rate extraction. Second, real-time prices can fluctuate so quickly that you end up chasing noise instead of patterns. By focusing on listing details that change more slowly — like room categories, promo language, and amenity positioning — you’re working with steadier signals that are easier to track over time.

Shifting the focus from numbers to context

Numbers tell you “what” a competitor is charging today. Context tells you “why” and “how” they might change it tomorrow. A hotel adding more premium room types, shifting amenities toward luxury, and reducing promotions is probably preparing to hold rates firm, even before those rates rise. The opposite — value-focused perks, heavy offers, and wide-open calendars — point toward a softer pricing stance.

The advantages of indirect monitoring

By watching the moves around pricing rather than the prices themselves, you can:

- Spot trends earlier — Listing changes often happen before rates adjust.

- Avoid false alarms — One-day price drops may be tied to short promos, but sustained listing changes are more reliable signals.

- Get a richer view — Prices alone don’t tell you about market positioning or demand pressure. Listings do.

How web scraping solutions make this scalable

Doing this manually means opening dozens — maybe hundreds — of Expedia listings and tracking small changes week after week. It’s easy to miss something. With web scraping solutions, you can pull structured listing data — like amenity lists, room order, promo text, and availability counts — automatically and compare them side by side over time. It’s faster, more accurate, and lets you see changes as soon as they happen.

This approach isn’t just an alternative to direct rate scraping — for many hotels, it’s a smarter first step in competitive intelligence. You’re not chasing prices; you’re understanding the strategy behind them.

Why Scale and Accuracy Matter in Data Collection

Catching a small change in one Expedia listing is interesting. Catching that same change across dozens of competitors at the same time is powerful. Scale is what turns scattered observations into reliable insights, and accuracy is what makes those insights trustworthy. Without both, your picture of the market will always be incomplete.

The problem with manual tracking

Manually checking listings might work if you only care about one or two competitors. But in reality, hotels don’t compete in a vacuum — they’re up against a mix of direct rivals, alternative accommodations, and new market entrants. By the time you’ve clicked through all those listings, the details may have already changed. Manual tracking also leaves too much room for human error. A missed promo, a misread room category, or an unspotted availability change can throw off your conclusions.

Structured data is key

It’s not enough to have “some” data. You need it structured so you can compare like with like. That means every room type, amenity, and offer is logged in a consistent way. Without structure, trends are hard to spot — it’s like trying to compare apples to oranges. With it, you can line up competitors’ listing details side by side and see changes clearly.

Sow scale changes the game

When you track listing data for an entire competitive set — or even across a region — patterns emerge that you’d never see from a single property. You might notice that several hotels launch similar promotions in the same week, or that premium rooms start creeping higher in multiple listings ahead of a holiday. These coordinated moves are often tied to broader demand signals in the market, which you can respond to faster if you spot them early.

Where web scraping solutions come in

Scaling this kind of tracking without automation isn’t realistic. PromptCloud’s web scraping solutions allow you to pull Expedia listing data or travel data at whatever frequency you need, daily, weekly, or seasonally, and deliver it in a clean, ready-to-analyze format. That means you’re not just collecting information; you’re building a living dataset that grows more valuable with every update.

With accuracy and scale on your side, you’re no longer reacting to the market. You’re anticipating it. And in a space as competitive as hospitality, that’s the edge every revenue manager wants.

Case Study – How a Hotel Chain Improved Occupancy by Reading Between the Lines

Sometimes the easiest way to understand a strategy is to see it in action. Let’s take the example of a mid-sized hotel chain operating in a popular coastal city. They weren’t struggling exactly — occupancy rates were steady — but their revenue manager felt they were missing opportunities to capture more high-value guests during the shoulder seasons.

Step 1: Watching the competition without touching prices

Instead of diving straight into price scraping, the team started by monitoring Expedia listings for their five closest competitors. They tracked room categories, amenity highlights, promotions, and visible availability over several months. This was all done using automated web scraping solutions, which meant they could collect fresh, structured data every week without adding manual workload.

Step 2: Spotting an unexpected pattern

One competitor — a similar 4-star property just a few blocks away — began highlighting a new “executive sea-view suite” in the prime slot on their listing. At the same time, they dropped mid-tier rooms further down the page and stopped offering free breakfast. Promotions became rare, appearing only for short weekday gaps.

Over the next two months, two other hotels followed the same pattern: new premium room types, more luxury-focused amenities, and a noticeable pullback on discounts.

Step 3: Adjusting their strategy

The chain’s team realized this was a coordinated move toward premium positioning ahead of the summer season. Instead of competing purely on value, they restructured their top two room categories to add more perks, including balcony access and complimentary wine, and moved them higher on their Expedia listings. They also reduced discounts for those rooms, focusing their offers on standard and economy options instead.

Step 4: The results

By the time summer arrived, the chain had shifted its guest mix to include more high-spend travelers while still keeping budget-conscious guests in the pipeline. Occupancy rose by 8% compared to the previous year, but more importantly, average daily rate (ADR) increased by 12% during peak months.

The takeaway? Even without touching a single price point, the team was able to anticipate a market shift and adjust in time to profit from it.

The Hidden Gold in Expedia Listings

To most people, Expedia is just where you go to compare hotels and maybe find a deal. But if you look at it through the eyes of a hotel revenue manager, it’s something else entirely — a giant public display of what your competitors are doing. The order of the rooms, the perks they choose to shout about, the way promotions appear and disappear — none of it is random. Together, these details give you a sense of how they’re thinking about price and positioning.

The best part? You don’t even need to touch their actual rates to figure it out. By focusing on what’s around the prices — the structure of the listing, the extras on offer, the timing of special deals — you can piece together patterns that point to their next move. And if you keep watching over weeks or months, those patterns become clearer.

This isn’t about spying; it’s about being ready. Hotels that notice these shifts early can react faster, adjust their offers, or reframe their positioning before the competition gets ahead.

Doing that manually is slow and easy to mess up, which is why having a web scraping solution matters. PromptCloud can pull all that listing data for you — clean, consistent, and ready to compare — so you can spend less time clicking through pages and more time making the decisions that keep you competitive. Schedule a demo today!

FAQs

1. Can I understand competitor pricing without directly scraping their prices on Expedia?

Yes. If you keep an eye on what’s shown in their listings — the perks they highlight, the promotions they run, and how availability changes — you can get a pretty good sense of their pricing approach. You’re reading the signals around the numbers, not the numbers themselves, which often tells you just as much.

2. How often should I track Expedia listings to spot trends?

For one-off checks, you might spot something interesting, but to see real patterns, weekly tracking works best. It’s frequent enough to catch small shifts as they happen but not so often that you’re drowning in data. Over time, you’ll start to notice the cycles.

3. Is this type of data collection legal?

Collecting publicly available information from listings can be done in a way that follows terms of service and local laws. The key is that you’re only gathering what any traveler could see on the site, without scraping live prices or accessing restricted data.

4. Can smaller hotels benefit from this approach?

Definitely. You don’t have to be a big chain to use competitor insights. For smaller hotels, it’s actually a great way to stay competitive — especially if you can spot opportunities or market gaps faster than the big players.

5. How does PromptCloud help with hotel price monitoring without scraping prices?

PromptCloud’s web scraping solutions can pull structured details from Expedia listings — things like amenities, promo language, and availability — and deliver them at scale. That means you get clean, ready-to-use data to compare and analyze without going near the actual prices.