**TL;DR**

In this piece, we’ll unpack how financial datafication reshapes banking operations, risk modeling, fraud detection, and customer engagement. You’ll see how alt-data in finance from online behavior to transaction metadata is being scraped, structured, and analyzed for real-time insight.

We’ll also look at how compliance, AI, and data quality shape the future of this transformation. From retail banks modernizing lending workflows to fintechs building credit models on digital footprints, datafication is redefining what “financial intelligence” means. If your business runs on financial data, this guide will show how to make that data actionable and why clean, compliant data pipelines matter more than ever.

When Finance Turned Into Data

A few years ago, a banker’s most valuable skill was intuition. Every swipe, transfer, payment, and login now produces a trail. These trails, when connected, tell complete financial stories. They reveal how customers behave, how markets move, and how institutions can act faster. This transformation is what the industry now calls datafication in banking.

It’s the process of converting every interaction into structured, analyzable data. What used to be anecdotal becomes measurable. Customer preferences, loan histories, portfolio shifts, even social sentiment all converted into data points that feed financial models. For banks and fintechs, this means decisions are no longer limited to historical reports. Credit scoring can incorporate behavioral signals. Fraud detection can adapt in real time. And customer personalization no longer relies on demographics alone but on digital context the “why” behind every transaction.

This is also where financial scraping enters the picture. To stay competitive, institutions need access to alternative datasets that go beyond their own walls: job postings, ESG disclosures, consumer sentiment, or even crypto chatter. Collecting, cleaning, and integrating that information at scale is now as important as the trading algorithms or the analytics dashboards built on top of it.

In short, banking has become a data business. And those that treat data pipelines with the same rigor as compliance frameworks are the ones leading the industry forward.

What Datafication in Banking Really Means (and What It Isn’t)

At its core, datafication isn’t about digitizing what already exists. Banks did that decades ago. It’s about redefining financial activity as data from the very start not as an afterthought.

A loan approval, for instance, used to be a form, a phone call, and a signature. Now it’s a structured sequence of digital events. Each click, timestamp, or document field adds context: how long an applicant spent reading terms, whether income verification matched prior records, how often they check their mobile app after applying. That behavior is data. In this world, data doesn’t just describe a transaction. It is the transaction.

When we talk about datafication in banking, we’re describing three things happening simultaneously:

- Everything becomes measurable.

Every customer action logins, payments, card swipes, chats are converted into analyzable signals. - Insights become continuous.

Banks don’t wait for quarterly reports. Dashboards update in real time, and decisions follow. - Systems become self-improving.

AI models learn from every new data point. Credit engines get smarter, fraud filters more precise, recommendations more relevant.

That’s the power of financial datafication: a living, breathing feedback loop instead of static reports.

What It’s Not

It’s easy to mistake datafication for simple digitization, analytics, or automation. Those are components, but not the essence.

- Digitization converts paper to pixels.

- Analytics explains what happened.

- Automation executes tasks faster.

Datafication goes further. It turns the process itself into data. Every internal workflow, customer touchpoint, and external signal becomes part of a continuously learning system.

Your data collection shouldn’t stop at the browser. If your scrapers are hitting limits or you’re tired of rebuilding after every site change, PromptCloud can automate and scale it for you.

What are the New Sources of Financial Data in 2025?

The most interesting financial data isn’t coming from balance sheets anymore. It’s coming from the spaces between them the traces of behavior, communication, and context that happen before a transaction ever hits the books. This is where datafication in banking truly stretches its boundaries. Traditional data used to mean account histories, credit bureau scores, and quarterly statements. Now, banks and fintechs are integrating what’s called alt-data in finance, a broader set of signals that help them see risk and opportunity earlier.

Here’s what that ecosystem looks like today:

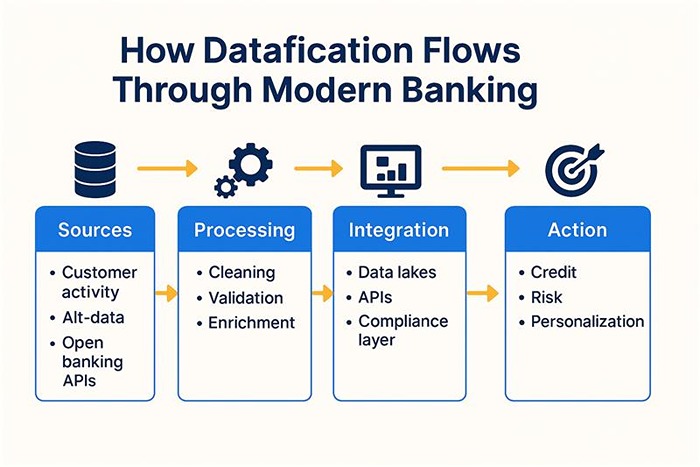

Figure 1: How Datafication Flows Through Modern Banking – a five-step pipeline showing how financial data moves from collection and processing to integration, analysis, and business action.

1. Customer Interaction Data

Every tap on a mobile banking app, chatbot session, or card decline produces insight. How often users log in, how they navigate menus, and which features they ignore all reveal intent. For example, a sudden spike in “loan calculator” usage can hint at rising credit demand before any application is filed. That’s demand forecasting through user behavior.

2. Web and Market Signals (Alt-Data)

This is where financial scraping comes into play. Banks scrape structured and unstructured data from multiple public sources:

- Job postings for hiring trends in target industries

- Company filings for early signs of distress

- News sentiment and social chatter for market volatility

- ESG disclosures for investment scoring

When cleaned and integrated, these data streams create what used to be impossible real-time market awareness at the dataset level. (For a deep dive into this process, see how web scraping transforms finance.)

3. IoT and Device Data

ATMs, mobile wallets, and connected devices generate continuous telemetry. Patterns like usage spikes in specific regions can predict demand for cash logistics or flag unusual transaction routes before fraud surfaces.

4. Partner and Open-Banking Feeds

APIs between institutions are the final link in the chain. Open-banking standards let fintechs pull account data (with consent) to build new services, budgeting tools, lending apps, risk dashboards. Every shared dataset becomes another building block for innovation.

How Datafication Is Reshaping Core Banking Functions

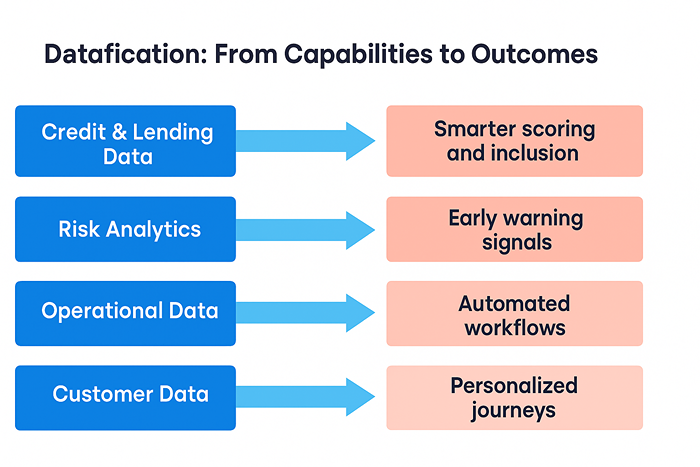

1. Credit Scoring Becomes Contextual

Credit used to be a number. A static score, updated once a month, built on income proofs and repayment history. Now it behaves more like a living profile. With financial datafication, banks don’t just evaluate how a customer performed in the past. They can see signals of intent in real time. A user paying down multiple small debts, changing payment frequency, or searching loan products shows early behavioral cues.

Modern scoring engines merge traditional bureau data with digital footprints. App activity, transaction trends, even sentiment from support chats contribute to a fuller picture. That makes credit more inclusive, allowing customers with limited history but healthy digital behavior to qualify for better terms.

2. Risk Management Turns Predictive

The biggest change in datafication in banking is that risk is no longer only measured, it’s forecasted. ML models, when integrated with financial scraping, these systems also monitor external conditions, sector layoffs, inflation chatter, or credit downgrades so exposures can be adjusted early.

One regional bank used this approach to cut default risk by identifying early “stress signals” in small business accounts: fewer supplier payments, smaller invoice volumes, and higher utility spends. What used to take months of review now happens automatically in near real time.

3. Customer Experience Becomes Personal and Predictive

In digital banking, personalization has moved beyond simple “Hello, [Name]” greetings. Each data point becomes a context trigger. If a user’s balance dips right after a holiday, the app might show savings recommendations. If recurring transactions increase, it might suggest a tailored credit line.

The same datafication also improves service quality. AI chat assistants can analyze past conversations to anticipate customer intent before a query is typed. That kind of proactive support changes the relationship between bank and client; it feels less transactional, more advisory. Customer data in BFSI is no longer just for compliance or reporting. It’s the raw material for differentiated experiences.

The Infrastructure Behind Datafication

1. The Data Pipeline

A modern financial pipeline isn’t a single database. It’s a constantly moving stream of inputs, validations, and transformations. Customer data arrives from apps, ATMs, and APIs. Market data comes from public feeds and third-party aggregators. Then there’s the growing world of financial scraping automated collection of alt-data from news sources, filings, and websites.

Each dataset must be extracted, cleaned, and formatted to fit the bank’s schema before it enters analytics or AI models. That’s why managed web data services are gaining traction. They deliver structured, ready-to-use data without forcing teams to maintain scraping scripts or fix errors every time a source changes.

(See how to fix web scraping errors for a deeper look at why this matters.)

2. Data Governance and Compliance

Banks have some of the most sensitive information on the internet. They’re bound by strict regulations such as GDPR, PCI DSS, and national data protection acts. Governance here means more than encryption and access control. It means traceability. Leading banks now maintain data lineage maps, visual records of every pipeline connection.

3. Role of AI

AI-driven credit scoring, sentiment tracking, and transaction clustering are now common. But where it gets interesting is adaptive AI systems that learn continuously, not in batches. For example, if fraud models detect a new pattern of coordinated account takeovers, they don’t wait for retraining cycles. They adapt the threshold automatically.

Why Infrastructure Decides Winners

The difference between data-rich and data-intelligent banks is invisible to customers. It’s the unseen infrastructure that ensures every insight is both fast and correct. A single weak link, a stale feed, a broken scraper, a missing validation can ripple across products and erode trust. Datafication rewards discipline. Banks that invest in pipeline reliability, governance, and continuous learning aren’t just future-ready; they’re already outperforming their peers.

Here’s a practical look at how banks today are leveraging data as a competitive advantage: ‘Banks Are Gaining Access To A Growing Amount Of Data — Here’s How To Use It’ (Forbes).”

How Financial Institutions Turn Datafication into Strategy

Most banks already collect massive amounts of data. What separates leaders from laggards is how they use it. Datafication isn’t valuable until it shapes decisions. That requires turning raw information into a strategic feedback loop one that influences everything from credit policy to customer engagement.

Figure 2: Datafication: From Capabilities to Outcomes – a bar graph connecting key financial data capabilities like credit, risk, operations, and customer data to measurable outcomes such as smarter scoring and personalized journeys.

1. From Dashboards to Decisions

Analytics used to end at reporting. Teams would generate weekly dashboards and hope managers made sense of them. Now, the same data streams power real-time triggers that act without waiting for a meeting.

- If a credit model flags an account as high risk, the lending system can pause further exposure automatically.

- If merchant transactions in a region surge unexpectedly, pricing engines can adjust fees or limits.

This “closed-loop decisioning” is what makes datafication operational instead of theoretical. It converts analysis into action, continuously.

2. Dynamic Product Design

With financial datafication, products can evolve based on customer behavior instead of fixed assumptions. A bank can observe that a segment frequently moves savings into short-term deposits, then roll out an adaptive hybrid account with auto-adjusting interest tiers.

Fintechs already do this. They watch how users interact with interfaces and modify features in near real time. In large institutions, this agility depends on integrating behavioral and transactional data across departments that used to work in isolation. Once that connection exists, product roadmaps can be informed directly by usage patterns, not just quarterly feedback.

3. Risk as a Strategic Asset

For decades, risk management was about avoidance. Datafication changes that posture. By quantifying more variables in real time, risk becomes a competitive differentiator.

Banks can now extend credit into newer markets because they can measure exposure minute by minute instead of by month-end. They can price loans dynamically, identifying when a borrower’s digital activity signals improved stability. This is how data turns uncertainty into opportunity. When handled correctly, real-time visibility doesn’t just protect capital, it grows it.

4. Customer Experience as a Flywheel

Datafication also transforms how banks think about customer lifetime value. Instead of viewing interactions as one-off events, they treat them as part of a living relationship.

When a customer engages more often, the bank learns faster, refines offers, and improves relevance. Better relevance drives more engagement, which in turn creates richer data. That’s the feedback loop driving the digital banking revolution: more usage means better insight, which drives smarter products that attract more usage again.

5. Collaboration Across the BFSI Ecosystem

Datafication thrives when data flows beyond organizational walls. Open banking APIs allow fintechs, insurers, and investment platforms to collaborate through shared data channels.

For example, an insurance provider can use a partner bank’s risk signals to offer dynamic premiums, while the bank uses claim data to refine its lending criteria. This kind of mutual data exchange turns competition into cooperation, provided it’s done with clear consent and compliance controls.

6. Measuring ROI on Datafication

Financial leaders often ask the same question: how do we measure the return on all this infrastructure? The simplest metric is decision velocity, how long it takes to move from data ingestion to business action. Other indicators include model accuracy, customer retention, and cost of manual intervention avoided. In practice, the ROI of datafication is not just cost savings but strategic optionality: the ability to pivot when conditions change because you can see those changes as they form.

The Challenges of Financial Datafication (and How Banks Can Overcome Them)

| Challenge | Impact on Banking | How to Overcome It |

| 1. Fragmented Legacy Systems | Outdated core platforms prevent seamless data flow across departments and slow the adoption of analytics or AI. | Use API-first integration to connect legacy systems with new digital layers instead of full replacements. Build modular data gateways that let information move securely and consistently. |

| 2. Data Quality and Validation | Inaccurate or duplicate data leads to flawed insights, credit misjudgments, and compliance issues. | Deploy real-time validation pipelines with automated schema checks and anomaly detection. Build a single source of truth for critical datasets. See How to Fix Web Scraping Errors 2025. |

| 3. Regulatory and Ethical Complexity | Non-compliance with GDPR, PCI DSS, or national data laws risks fines and reputational loss. | Treat compliance as part of design, not an afterthought. Maintain data lineage maps that trace every field’s origin, usage, and transformation for audit transparency. |

| 4. Bias and Model Drift | Machine learning models can inherit historical bias or degrade over time, producing unfair or inaccurate outcomes. | Run bias audits during every retraining cycle and require explainability before deployment. Retrain models with current, balanced datasets to prevent drift. |

| 5. Data Overload Without Purpose | Collecting more data than needed inflates storage costs and confuses decision-making. | Define clear business outcomes for each dataset (risk, efficiency, customer growth). Remove pipelines that don’t contribute directly to measurable goals. |

| 6. Security and Trust | As data pipelines expand, the attack surface for breaches and misuse grows. | Implement end-to-end encryption and strict access control. Educate staff on data ethics and transparency to reinforce trust with customers and regulators. |

Your data collection shouldn’t stop at the browser. If your scrapers are hitting limits or you’re tired of rebuilding after every site change, PromptCloud can automate and scale it for you.

FAQs

1. What does datafication mean in banking?

It’s the process of converting every financial interaction transactions, logins, chats, applications into structured, analyzable data. This lets banks make faster and more personalized decisions.

2. How is financial datafication different from digital transformation?

Digital transformation moves processes online. Datafication turns those processes into measurable data from the start, enabling automation, analytics, and AI-driven insights.

3. What are examples of alt-data in finance?

Alt-data includes signals from non-traditional sources like job postings, ESG filings, social sentiment, or market trends scraped from public sites. It helps banks assess risk and opportunity earlier than conventional data.

4. How can banks ensure compliance while using external data?

By using transparent, consent-based data pipelines and vendors who adhere to global data protection laws such as GDPR and PCI DSS. Regular audits and lineage tracking are key.

5. How does PromptCloud support financial datafication?

PromptCloud provides managed web data solutions that collect, clean, and deliver structured datasets for banking and finance. This supports use cases like market tracking, credit modeling, and competitive analysis while maintaining compliance and reliability.