Earlier this year, the logistics powerhouse disguised as retail giant—Amazon.com entered the Middle East by acquiring Dubai-based online retailer Souq.com, confirming that e-commerce in this region is poised to take off. At that time Emaar Malls PJSC, which runs the world’s biggest shopping center was also in the race with Amazon to acquire Souq and placed $800 million bid. Finally, the U.S.-based retailer acquired Souq.com and both of the parties didn’t disclose deal terms at that time. However, according to the SEC filings, it cost them $580 million.

Current e-commerce market

If we look at a report published by BMI Research, the Middle East is one the fastest growing Ecommerce markets in the world. It is also projected that the sales volume of this region will grow to $4.3 billion in 2020 from $22.3bn in 2016. According to a report by Gartner, there is huge growth opportunities in this region — primarily considering the fact that only 15% of the businesses in this region have an online presence, and 90% of online retailers bring in product from outside the region.

Amazon has been bolstering its overseas expansion after mostly ceding Chinese market to the Alibaba Group. This is crucial for them, as the other high-value countries like India are mostly cash-bleeding ground owing to fierce pricing war (because of Flipkart). Note that it has committed $5 billion investment in the next few years in India. Hence, the Middle East is quite important to them in the international arena as online shopping is gaining ground in countries such as Bahrain, Qatar and the United Arab Emirates and they are not facing stiff competition from others players.

Souq’s acquisition

Since the core market for Amazon has matured, it is imperative for them to look for other avenues of growth. In that sense, Souq fits the bill — they are an entrepreneurial e-commerce startup looking for help in scaling and Amazon is looking for rapid entry in new markets. Souq.com is an well-established online store with understanding of the Middle Eastern market that claims 45 million online visits per month. They are run by more than 3,000 people, sell north of 8 million products, from electronics and fashion to health and beauty. With this acquisition Amazon captured the largest market share instantly!

Souq had raised $275 million capital in February 2016 at $1 billion valuation. This deal is one of Amazon’s largest acquisitions in the last few years. As per a statement given by Amazon Senior Vice President Russ Grandinetti, both of the companies share the same DNA — driven by customers, invention and long-term thinking.

Improving shopping experience with better logistics

The Middle Eastern market is plagued with high trade barriers which adds to the complexities of online shipment of the products. Moving goods through customs can put any any company in a bureaucratic trap and this can get compounded by high tariffs, changing regulations and volatile currency exchange rates. Souq is an exception here considering they have been successfully delivering products to the six countries in the GCC (a customs union).

Now, Amazon and Souq are acquiring another startup called Wing.ae to strengthen the logistics further. This company is building out a network for same-day and next-day deliveries similar to Amazon Prime for various e-commerce marketplaces (including Souq.com). This is a key strategic area since faster delivery of products results in exceptional customer experience and, in turn, ensures rapid growth. This acquisition is the logical step since Souq had previously made strategic investment in Wing.ae and had been working with the company to help it scale. Interesting to note that according to Crunchbase listing, since the inception of Wing in 2016, Souq has been listed as the only investor.

Wing.ae had been working with a several marketplaces in this region by providing delivery services, and that partnership will be supported if they meet the minimum requirement. But, as mentioned earlier, the Middle East is still at a nascent stage for these type of services, so this ensures that there is ample scope of growth along with competition. According to official press release – “this investment will be used to strengthen Wing’s technology, infrastructure and regional coverage to provide innovative delivery solutions and to make online shopping for SOUQ.com customers and merchants even more convenient”.

Accelerating Amazon Prime

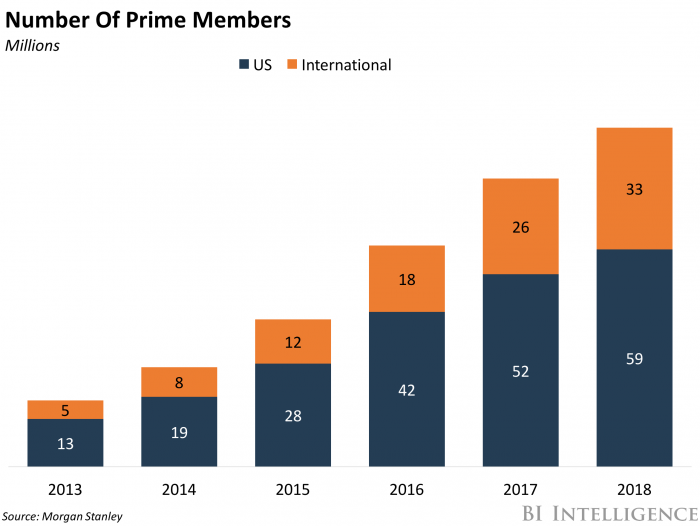

Success in MENA region is critical for Amazon as it aims to improve its international business. They have struggled overseas, and the Prime subscription had slow growth rate, which posed as a hindrance to replicate its dominance similar to the US.

In that context, Souq and Amazon’s acquisition of a startup that will help them stay ahead of competition in a domain that has been one of Amazon’s intrinsic strengths, logistics. Wing.ae’s fast-delivery network will boost Amazon’s Prime business roll out into the region. Since Amazon Prime is a subscription-based service that provides free and fast shipping to members on wide range of products along with a bunch of other perks like music and video services, this can definitely be enticing to the Middle Eastern consumers.

Impact on the competitors

Amazon’s arrival is definitely alarming for the local online stores. As mentioned earlier, they are more of a gigantic logistics facility than an e-commerce store and the acquisition of Souq.com will help them build improved facilities in the Middle East. They can most definitely offer a wide range of products and outpace the local e-commerce companies in terms of delivery time. It is also quite understood that they would be heavily investing in huge marketing campaigns to get the locals in the region subscribe to Prime membership. Amazon’s customer-centric approach coupled with a mission to provide widest range of products at the lowest price makes it a formidable competitor.

Emaar Mall, that missed out on a bid to buy Souq, has made another acquisition to secure its position in e-commerce. Back in May, Rocket Internet — the Berlin-based e-commerce incubator — announced that it has sold 51 percent of Namshi (a profitable venture), its Middle Eastern Amazon clone, to Emaar for $151 million. It’s not surprising that there are these type of ambitious investments focused on some of the new online marketplaces. And these investments are closely coupled with the delivery aspect of online retailing as well. Mohamed Alabbar, whose firm in the owner of The Dubai Mall and the Burj Khalifa has acquired a stake in logistics company Aramex and invested $1 billion in Noon, an e-commerce store that’s competing with Souq.

Takeaway

The Amazon-Souq-Wing partnership has arrived at a time when the Middle East is witnessing growth in eCommerce marketplaces. For Amazon, gaining substantial market share is key to its growth, as majority of the company’s revenue still comes from its home market. The investment in Souq is line with its aim to capture and establish its position in the international retail space. Irrespective of the outcome, unquestionably, the consumers of the MENA are the ones who stand to win.